Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

When it comes to buying a home, the conversation always seems to turn to interest rates. Headlines often warn that rates are “high” or “rising,” and it’s easy to feel like waiting is your only option. But here’s the truth: you don’t need to be afraid of today’s mortgage rates. In fact, buying now may be more beneficial than you think.

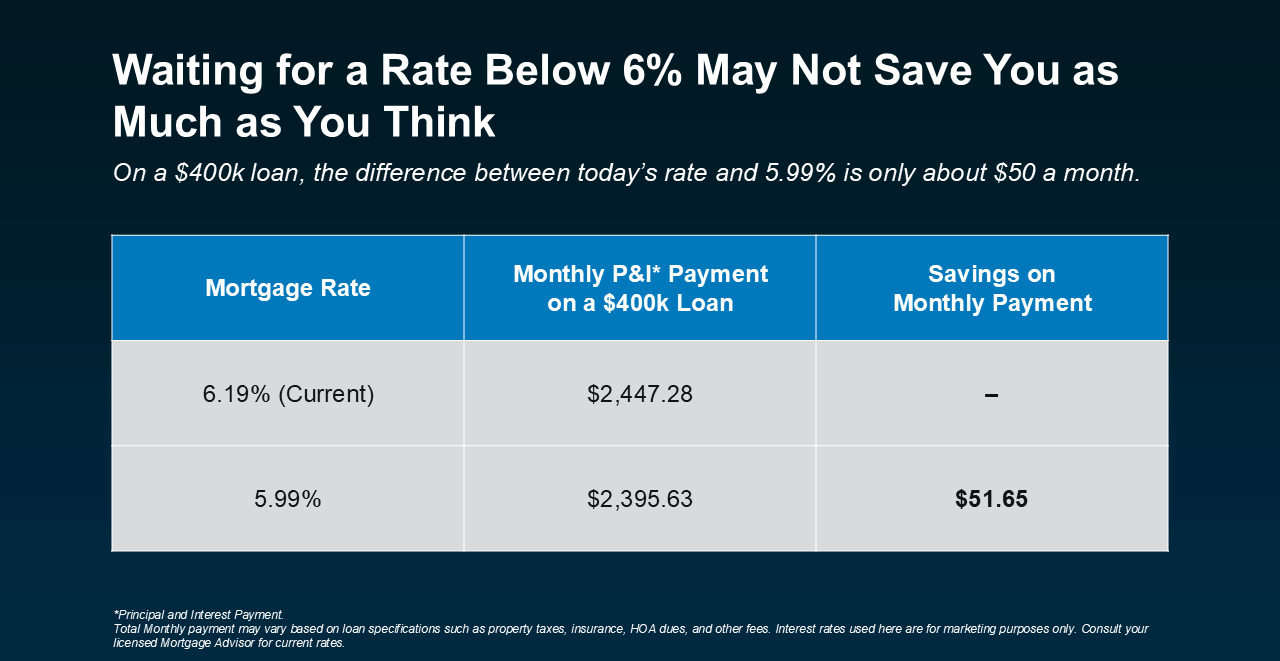

1. Rates Are Only One Part of the Equation

It’s easy to fixate on the exact percentage, but mortgage rates are just one piece of the puzzle. Your monthly payment is also influenced by the price of the home, your down payment, property taxes, and insurance. Even if rates seem higher than last year, smart planning and budgeting can keep your monthly payment manageable.

2. Waiting Can Cost More Than Acting

While you wait for rates to drop, home prices continue to rise in many markets. That means the longer you wait, the more you may end up paying for the same property. Sometimes locking in a mortgage now, even at a slightly higher rate, can save you money in the long run because the overall cost of the home may be lower than it would be in the future.

3. You Can Still Find Great Loan Options

There’s more than one type of mortgage. Adjustable-rate mortgages (ARMs), FHA, VA, and other loan programs can provide flexible solutions that fit your financial situation. Mortgage rates may feel intimidating at first glance, but there are plenty of tools available to make homeownership more affordable.

4. Homeownership Brings Long-Term Benefits

Buying a home isn’t just about today’s rate—it’s about building wealth and stability for years to come. Every mortgage payment contributes to your equity, and owning a home can be a hedge against inflation and rising rent costs. Over time, the benefits of owning often outweigh short-term fluctuations in rates.

5. Expert Guidance Makes a Difference

Navigating mortgage rates and loan options can feel overwhelming, but working with a knowledgeable lender or real estate professional can help you understand what makes sense for your goals. They can help you find strategies to make your home purchase affordable, even in a higher-rate environment.

Bottom Line

Don’t let fear of mortgage rates hold you back. Rates are just one factor, and with careful planning, the right strategy, and professional guidance, you can still secure a home that fits your budget and your future. Waiting for the “perfect rate” may cost more than acting today—so explore your options and take the first step toward homeownership with confidence.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts