The Housing Market Is Turning a Corner Going into 2026

As we approach 2026, the housing market is showing signs of a significant shift. After years of fluctuating interest rates, changing buyer demand, and affordability challenges, many analysts are beginning to see opportunities emerging for both buyers and sellers. Here’s what’s driving this turning point and what it could mean for the year ahead.

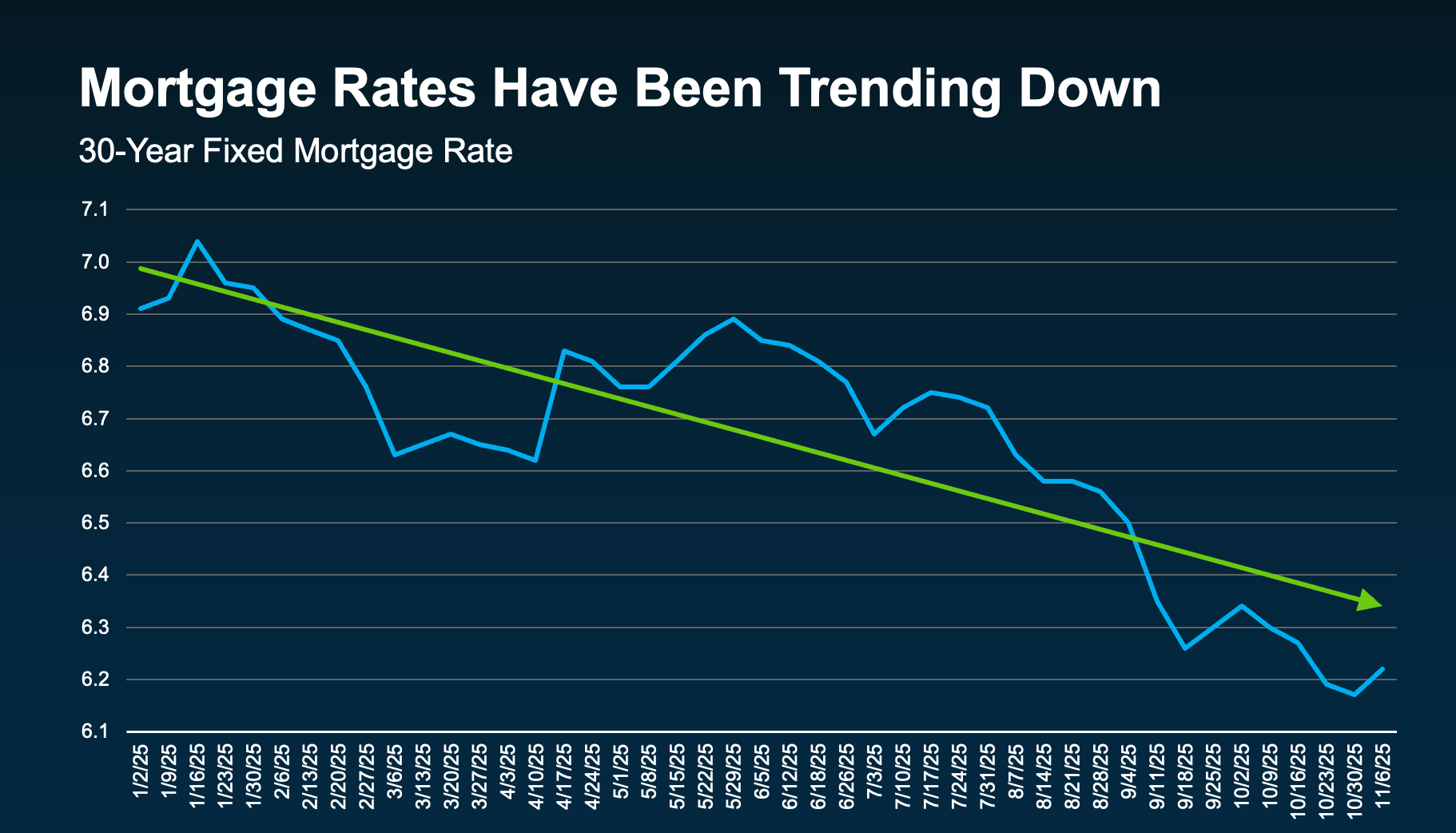

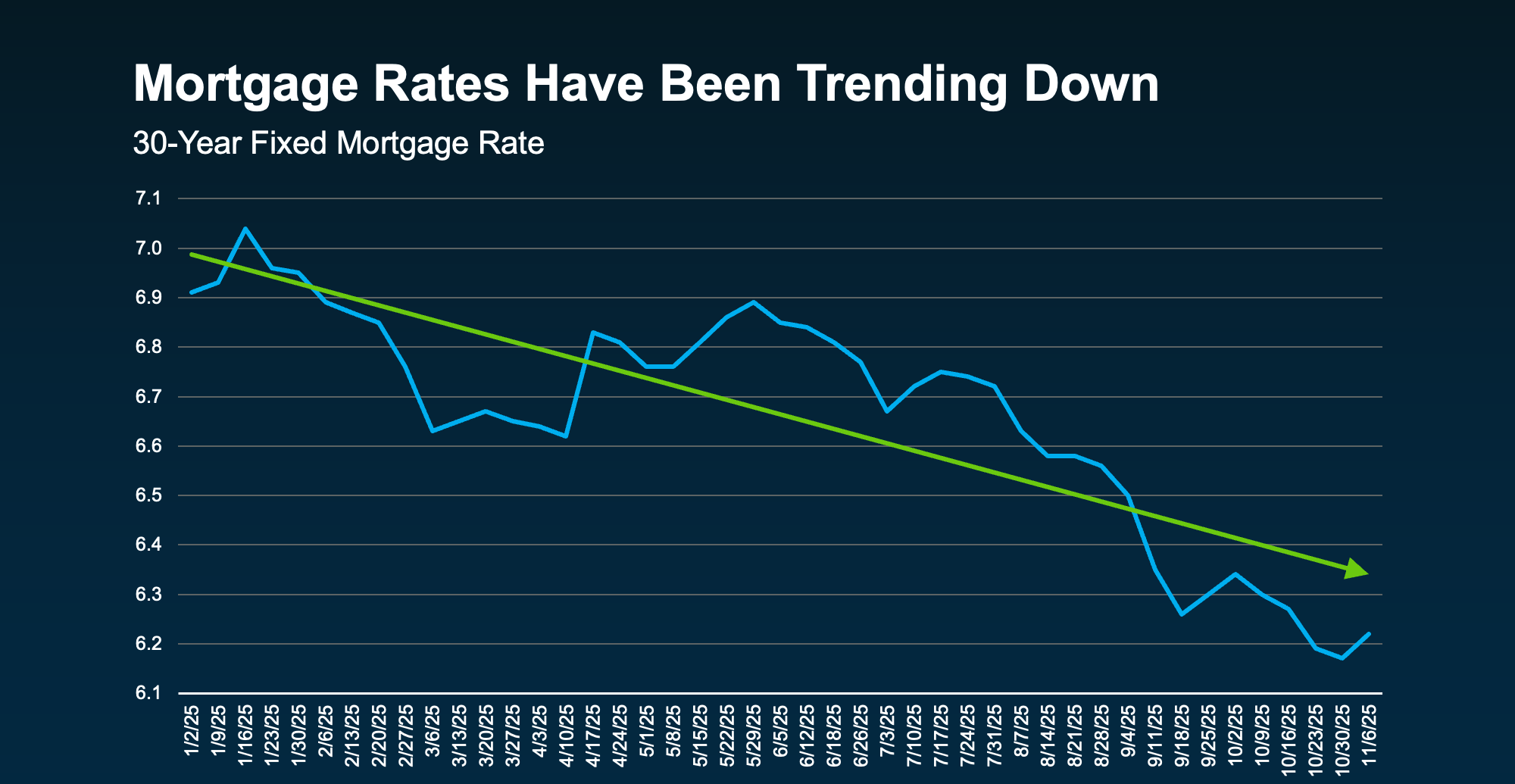

1. Interest Rates Are Becoming More Predictable

After a period of record volatility, interest rates are beginning to stabilize. This provides homebuyers with more confidence to make long-term financial decisions. Even modest decreases in mortgage rates can translate into thousands of dollars in savings over the life of a loan, increasing purchasing power and encouraging more transactions.

2. Increased Affordability in Certain Markets

While affordability has been a major concern in recent years, some regions are seeing a softening in home prices. Combined with stabilized rates, this opens doors for first-time buyers and those looking to upgrade. Buyers who were previously priced out are now finding opportunities to enter the market without overextending their budgets.

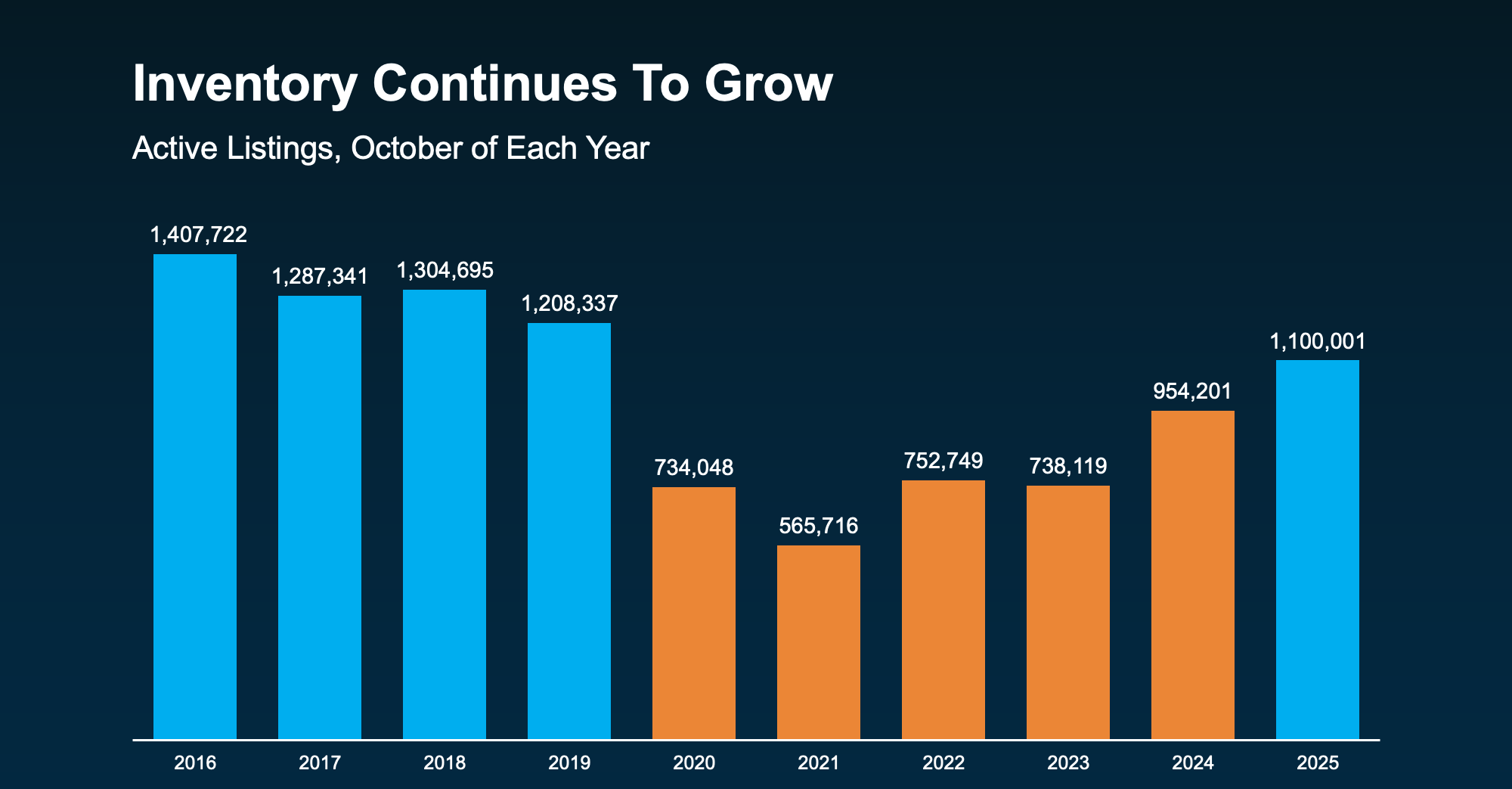

3. Inventory Is Slowly Rising

One of the biggest challenges in recent years has been limited housing inventory. Entering 2026, inventory levels are beginning to improve in several key markets. More homes on the market mean increased options for buyers and slightly less competition, creating a healthier, more balanced market.

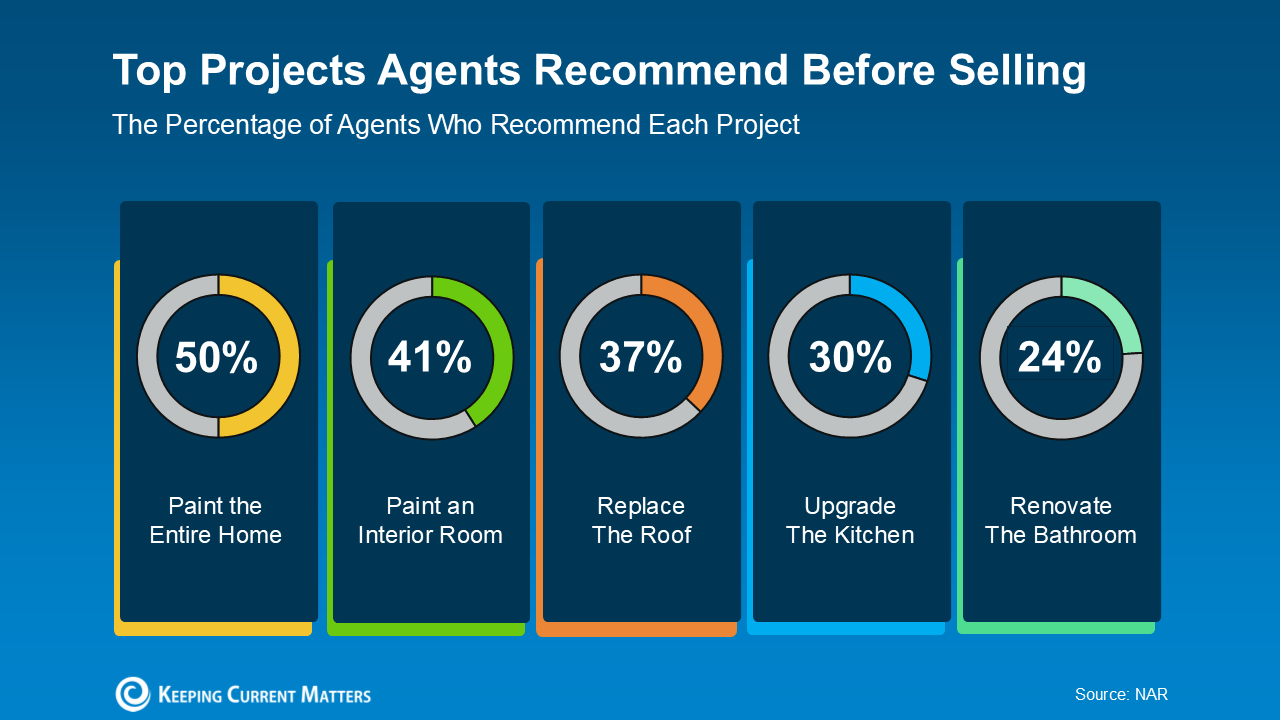

4. Sellers Can Still Benefit

Even with the market stabilizing, sellers can still find opportunities to get favorable returns—especially those who strategically price and market their homes. While the frenzy of multiple-offer situations may be cooling, the demand for quality homes in desirable neighborhoods remains strong.

5. Market Sentiment Is Shifting

Perhaps the most important change is the shift in market sentiment. Buyers and sellers are approaching transactions with more clarity and confidence, no longer driven solely by fear of missing out or drastic rate swings. This leads to smoother negotiations, more realistic pricing, and ultimately, a healthier housing ecosystem.

What This Means for 2026

-

For Buyers: It’s a great time to explore options, especially for first-time homeowners or those looking to move up. Stabilized rates and increased inventory provide more leverage.

-

For Sellers: While the market may not be as frenzied as in prior years, well-prepared listings in sought-after areas can still achieve excellent results.

-

For Investors: Opportunities are emerging for those looking to invest in rental properties or flip homes, particularly in markets with strong employment growth and steady demand.

In short, as 2026 approaches, the housing market is entering a more balanced phase. Buyers, sellers, and investors alike can navigate the market with greater confidence, knowing that the extreme volatility of recent years is easing. Whether you’re looking to buy your dream home or capitalize on your current property, the turning corner presents a promising outlook.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (111)

- Agent (103)

- Baltimore (98)

- Baltimore Real Estate (95)

- Buying (93)

- Closing Cost (10)

- Commercial Real Estate (92)

- D.C (95)

- Downsizing (87)

- Equity (107)

- First time homebuying (86)

- home buying tips (89)

- Home Selling (64)

- home selling tips (25)

- Homebuying (89)

- Investing (101)

- Lower Prices (102)

- Market Reports (82)

- Market Update (84)

- Maryland (101)

- Maryland Real Estate (101)

- mortgage (81)

- mortgage rates (83)

- purchasing a home (89)

- Real Estate (105)

- Real Estate Agent (105)

- Real Estate Report (79)

- Retirement (83)

- Selling (67)

- VA Loan (6)

- Veterans (7)

- Washington D.C (88)

Recent Posts