The Real Benefits of Buying a Home This Year

If you’ve been on the fence about purchasing a home, this year may be the perfect time to make the move. While the real estate market fluctuates, homeownership continues to be a solid investment with numerous benefits. Whether you’re a first-time buyer or considering an upgrade, here’s why buying a home this year could be a game-changer for your future.

1. Building Long-Term Wealth

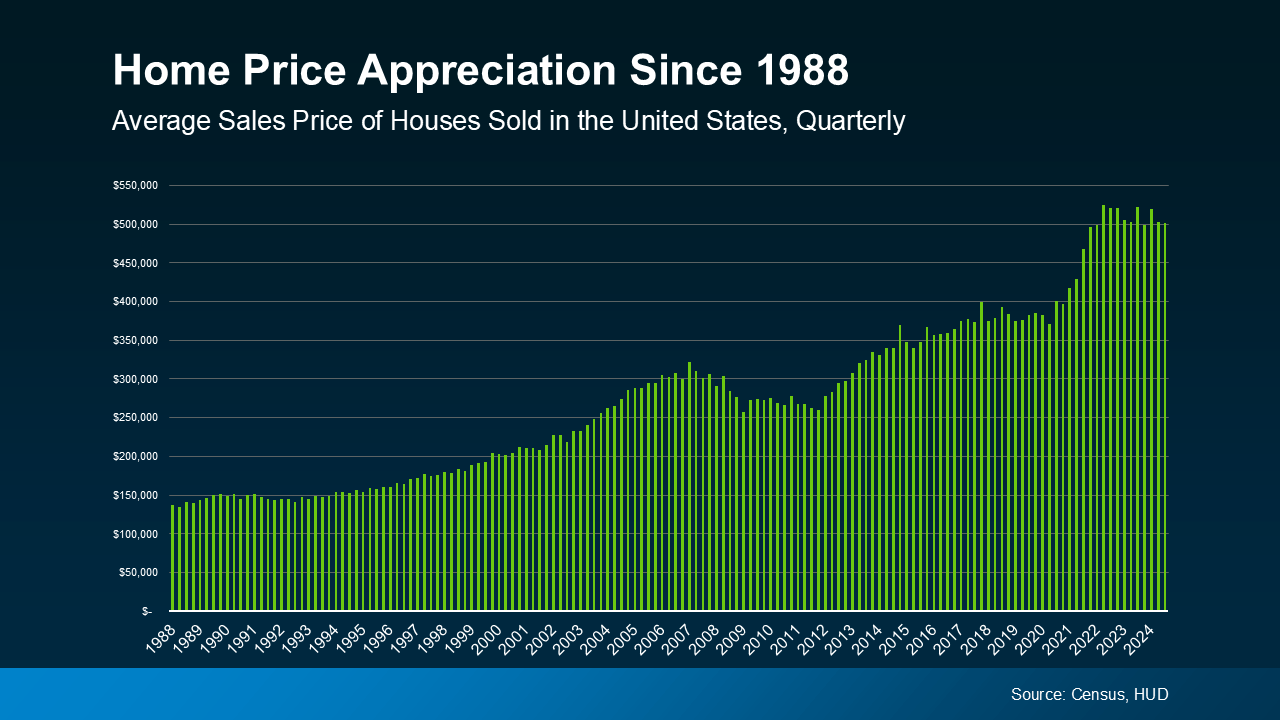

Owning a home allows you to build equity over time. Instead of paying rent, your monthly mortgage payments contribute to your ownership, creating long-term financial security. As home values appreciate, so does your investment, potentially giving you a return when you decide to sell in the future.

2. Stability and Control Over Your Living Space

When you own a home, you have the freedom to make modifications without needing a landlord’s permission. You can customize your space, improve its value, and truly make it your own. Additionally, with a fixed-rate mortgage, your monthly payments remain stable, unlike rent, which tends to rise over time.

3. Potential Tax Benefits

Homeownership often comes with tax advantages, such as deductions on mortgage interest and property taxes. These savings can add up significantly, making owning a home more financially rewarding than renting in many cases.

4. A Stronger Sense of Community

Buying a home means putting down roots and becoming part of a community. Homeowners tend to stay in their homes longer than renters, fostering a sense of stability and connection with neighbors. This can be especially beneficial for families looking for a great environment for their children.

5. Protection Against Inflation

Real estate is one of the best hedges against inflation. As living costs rise, fixed mortgage payments remain the same, helping homeowners maintain financial stability. Meanwhile, rents often increase, making homeownership a more predictable and secure option.

6. A Smart Investment for Your Future

Real estate has historically been a sound investment. Over time, home values tend to rise, allowing homeowners to build wealth. If you buy now, you can take advantage of market conditions and secure a home before prices increase further.

Take the First Step Toward Homeownership

If you’re considering buying a home this year, now is the time to start planning. Work with a trusted real estate professional to explore your options, secure financing, and find the perfect home for your needs. Investing in homeownership can set you up for long-term success, stability, and financial growth.

Ready to make the move? Let’s connect and find your dream home today!

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home's value appreciates. And that, in turn, makes your net worth grow too.

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home's value appreciates. And that, in turn, makes your net worth grow too.

Maybe that’s why, according to the National Association of Realtors (NAR), 79% of buyers believe owning a home is a good financial investment.

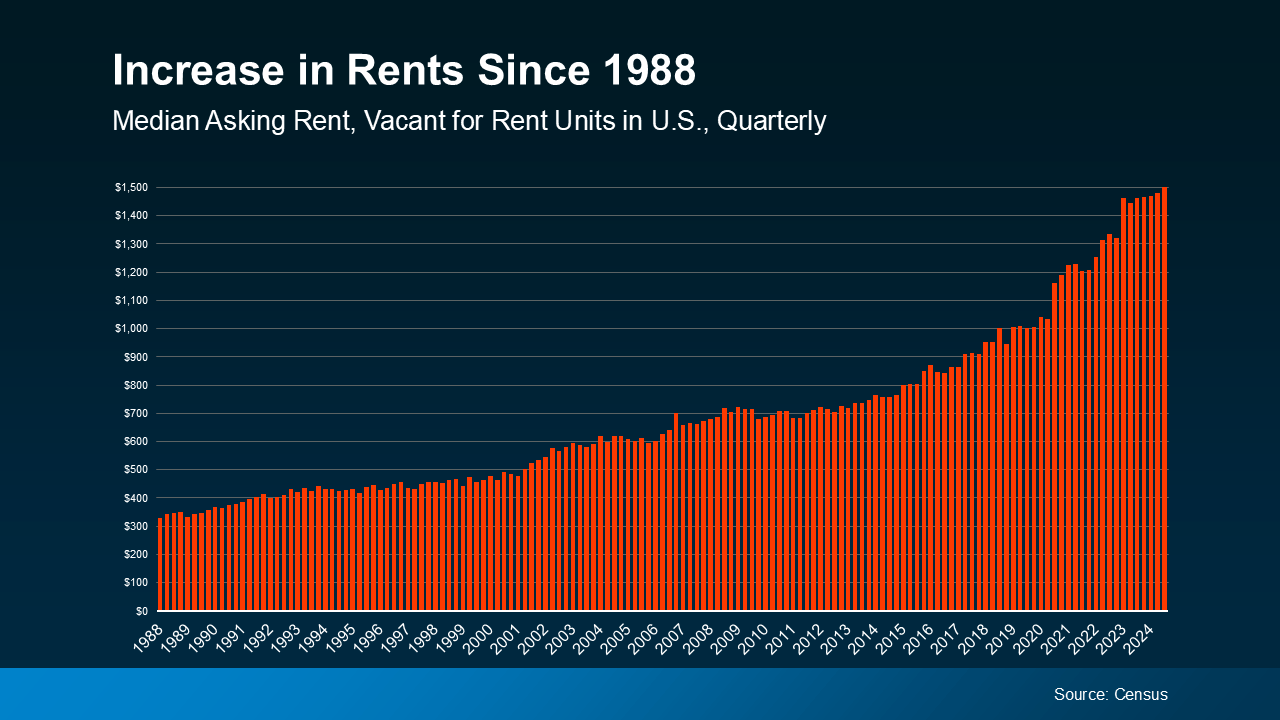

Renting Comes with Rising Costs

Renting may feel more affordable in the short term, especially right now with today’s home prices and mortgage rates. But the reality is, over time, rent almost always goes up too. Take a look at the data and you can see that play out. According to Census data, rents have significantly increased over the decades (see graph below):

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

Renting vs. Buying: The Long-Term Impact

When you own a home, your payments are an investment in your future. Renting, on the other hand, means your money is gone for good — it helps your landlord build equity, not you.

Renting works for those not ready (or able) to buy today. But if you are able to make the numbers work, buying a home builds equity and sets you up for long-term financial success. So, even though renting may seem easier now, it can’t match the benefits of homeownership.

Bottom Line

If you can afford it, take control of your financial future by making homeownership part of your plan. It’s an investment you won’t regret.

Do you want to see what starter homes are available in our market? Let’s connect today to explore your options. Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts