Many Veterans Don’t Know about This VA Home Loan Benefit

For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don't know about one of its core benefits.

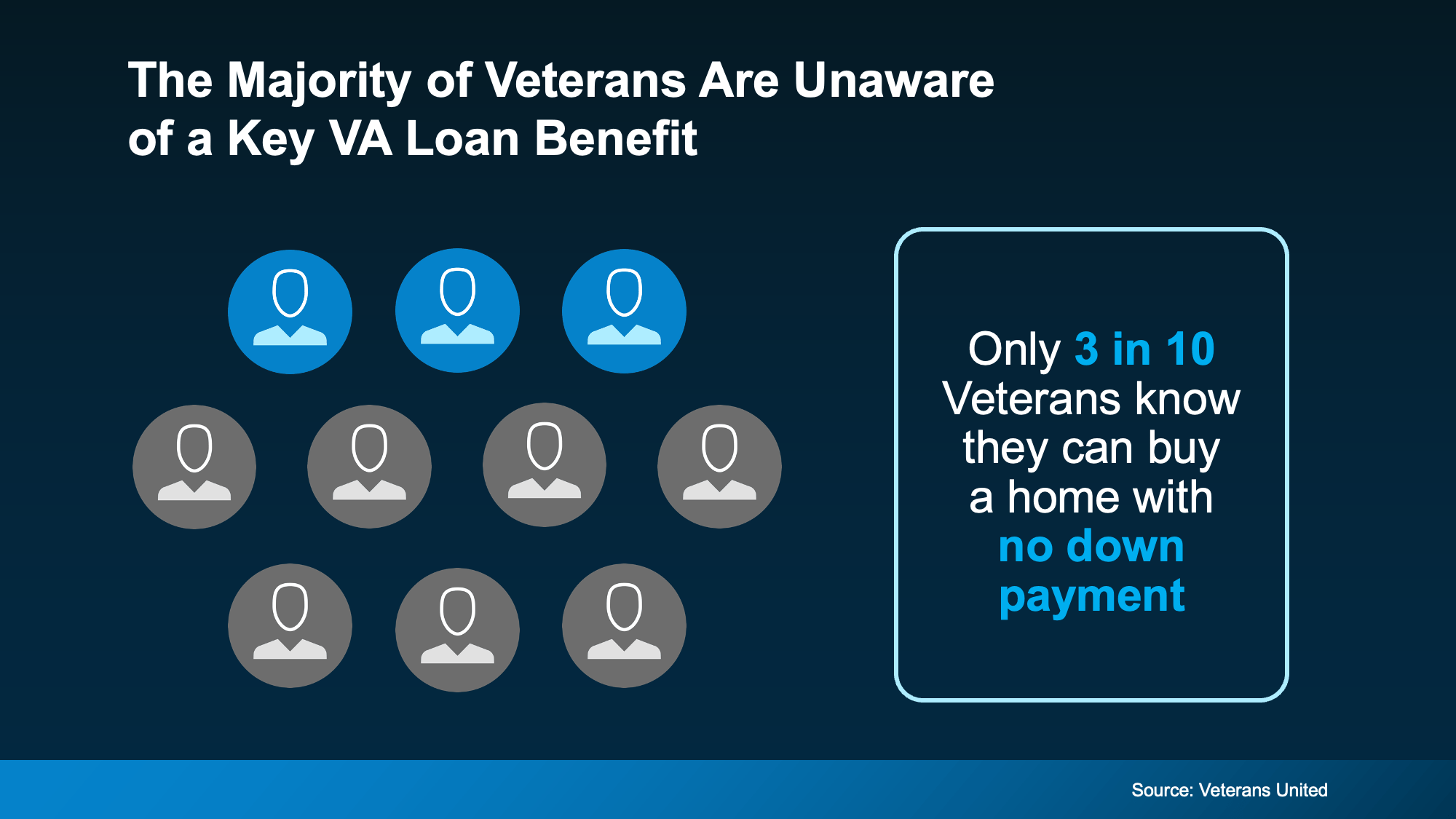

According to a report from Veterans United only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below):

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That’s why it’s so important for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry's lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to big savings over time.

For those who have served, the VA home loan program is one of the most powerful benefits available—but many veterans aren't aware of just how much it can do. Beyond the well-known zero down payment feature, there are lesser-known advantages that can save veterans thousands of dollars and make homeownership far more accessible. If you’re a veteran or active-duty service member, this might be the homebuying game-changer you’ve been waiting for.

The Little-Known Benefit: The VA IRRRL (Interest Rate Reduction Refinance Loan)

One of the most underutilized benefits of the VA loan program is the VA IRRRL, often called the “VA Streamline Refinance.” This program allows eligible homeowners to refinance their existing VA loan to a lower interest rate with minimal hassle.

Here’s what makes it so powerful:

-

✅ No Appraisal Required

-

✅ No Income Verification Needed

-

✅ No Out-of-Pocket Costs (in most cases)

-

✅ Lower Monthly Mortgage Payments

This means you could potentially reduce your mortgage payment without jumping through all the hoops required for traditional refinancing. And because there’s little to no paperwork, it can often close much faster than a standard refinance.

Why Don’t More Veterans Know About It?

Unfortunately, this benefit isn’t always well-publicized, and many veterans assume refinancing is a long, expensive process. Others simply don’t know they qualify. Some may not realize they can use this option even if they’ve only had their current VA loan for a short time—there’s no strict timeline required, as long as you meet the basic criteria.

Who Qualifies for the VA IRRRL?

To be eligible, you must:

-

Already have a VA-backed mortgage

-

Be current on your payments

-

Demonstrate a tangible benefit (like a lower interest rate or switching from an adjustable to a fixed-rate loan)

Even if your credit isn’t perfect or your income has changed, you might still qualify. That’s the beauty of this benefit—it’s designed to make things easier for veterans, not harder.

Other Hidden VA Loan Perks You Might Not Know About

While we’re at it, here are a few other VA loan benefits many overlook:

-

No private mortgage insurance (PMI)

-

Assumable loans, which can be a huge selling point if you move

-

Reusable benefit, meaning you can use it more than once

Final Thoughts: Don’t Leave Benefits on the Table

You’ve earned these advantages through your service—make sure you’re getting the most from them. Whether you’re buying your first home or looking to refinance and save, the VA home loan program has more to offer than most realize.

If you think you might be eligible for the IRRRL or want to explore your VA loan options, reach out to a VA-approved lender or a real estate professional familiar with VA benefits. A quick conversation could lead to big savings.

Need Help Navigating Your VA Loan Options?

We’re here to help you unlock every benefit you've earned. Contact us today for a free consultation.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts