Is It Better To Rent or Buy a Home Today?

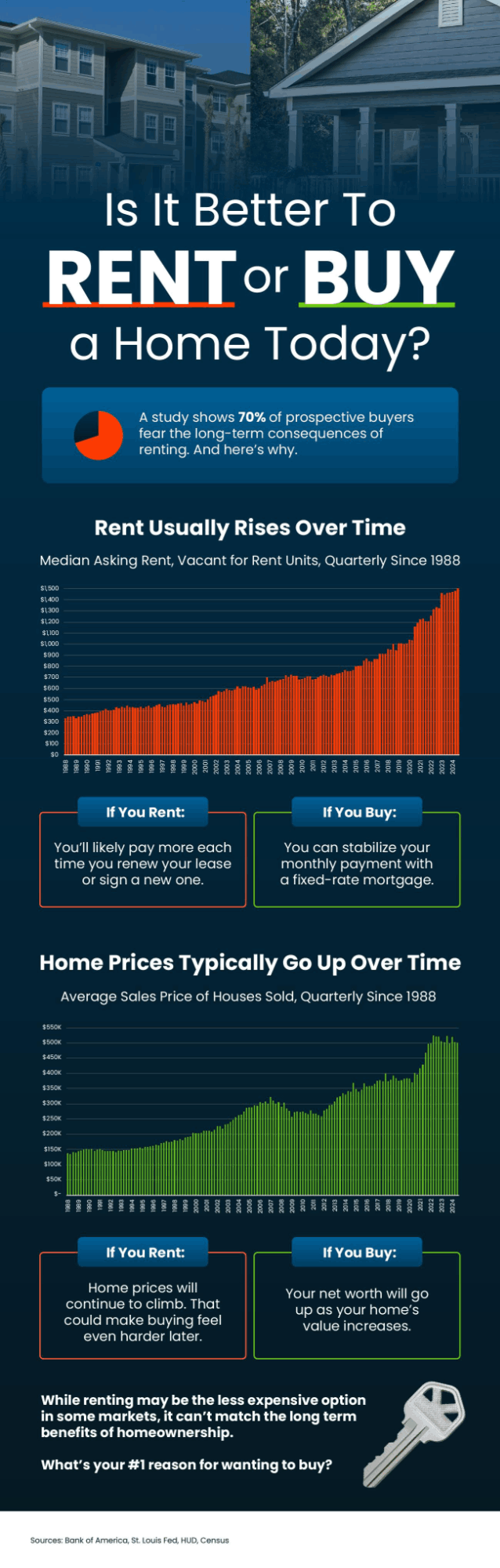

The age-old debate of renting vs. buying has never been more relevant than in today’s real estate market. With home prices fluctuating, interest rates shifting, and rental costs on the rise, deciding whether to rent or buy can be overwhelming. If you're trying to determine the best option for your situation, consider these key factors before making a decision.

Financial Considerations

Buying a Home: The Long-Term Investment

Buying a home can be a great financial decision if you're planning to stay in one place for a while. Homeownership builds equity over time, offering a long-term return on investment. Additionally, fixed-rate mortgages provide predictable monthly payments, unlike rent, which often increases annually.

However, homeownership also comes with additional costs, including:

-

Property taxes

-

Homeowners insurance

-

Maintenance and repairs

-

Potential HOA fees

If you're financially stable and can afford the upfront costs (such as the down payment and closing costs), buying a home may be a smart move.

Renting: Flexibility and Less Responsibility

Renting offers more flexibility, especially for those who may need to relocate for work or personal reasons. It also comes with fewer financial burdens—no property taxes, no costly maintenance, and lower upfront expenses.

However, rent prices tend to increase over time, and you won’t build equity as you would with homeownership. Additionally, you have less control over your living space and may be subject to landlord restrictions.

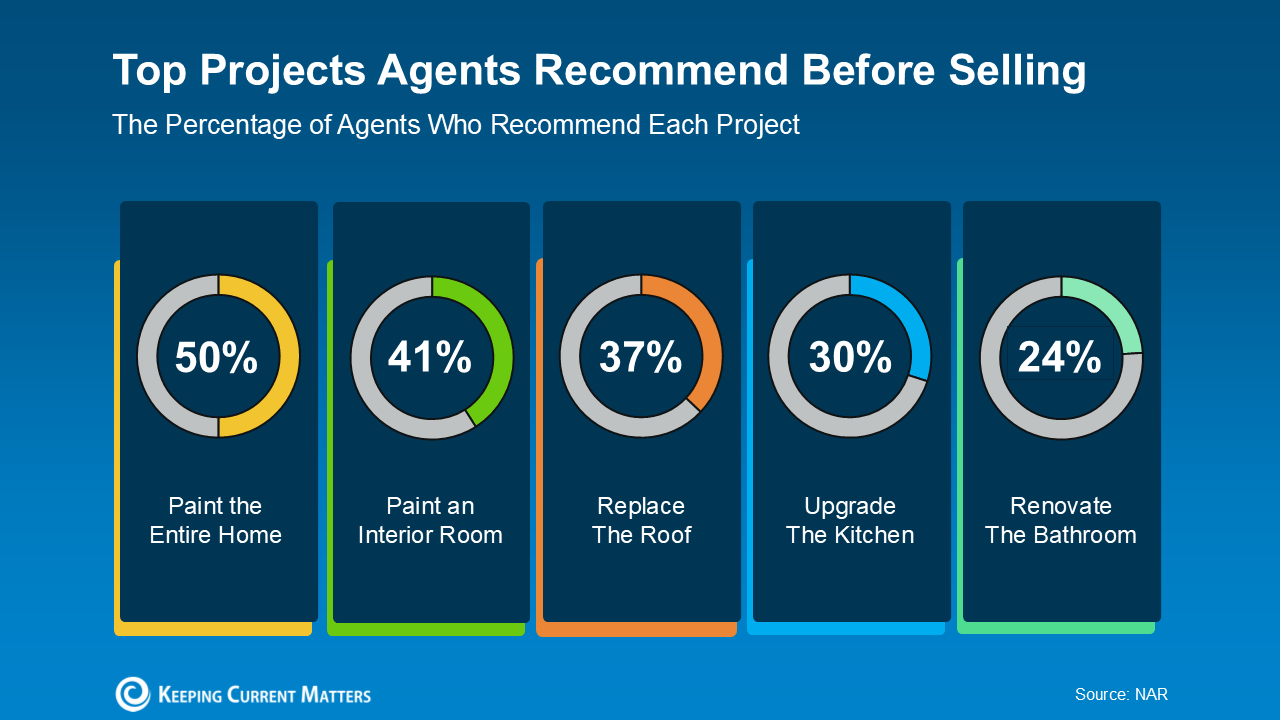

Market Conditions

Real estate market conditions can play a major role in whether buying or renting makes more sense. If home prices are high and mortgage rates are steep, renting may be the better short-term option. Conversely, if mortgage rates drop and inventory increases, buying could be a great opportunity.

Before making a decision, it’s important to analyze:

-

Interest rates

-

Home prices in your desired location

-

Local rental market trends

-

Economic factors affecting affordability

Lifestyle Considerations

Your personal lifestyle and future goals should also influence your decision. Ask yourself:

-

Do I plan to stay in the same area for at least 5 years?

-

Am I prepared for the responsibilities of homeownership?

-

Do I prefer stability or flexibility?

-

How do my long-term financial goals align with buying vs. renting?

Final Thoughts

There’s no one-size-fits-all answer to the rent vs. buy question. If you prioritize stability and long-term investment, homeownership might be right for you. On the other hand, if you value flexibility and lower upfront costs, renting may be the better choice for now.

Evaluate your financial situation, market conditions, and lifestyle needs to determine the best path forward. Consulting with a real estate professional can also help you make an informed decision tailored to your circumstances.

Are you considering renting or buying? Let’s discuss your options and find the best solution for your needs!

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (107)

- Agent (99)

- Baltimore (94)

- Baltimore Real Estate (91)

- Buying (91)

- Closing Cost (6)

- Commercial Real Estate (88)

- D.C (91)

- Downsizing (83)

- Equity (103)

- First time homebuying (84)

- home buying tips (87)

- Home Selling (60)

- home selling tips (21)

- Homebuying (86)

- Investing (99)

- Lower Prices (98)

- Market Reports (78)

- Market Update (80)

- Maryland (97)

- Maryland Real Estate (97)

- mortgage (77)

- mortgage rates (79)

- purchasing a home (86)

- Real Estate (101)

- Real Estate Agent (101)

- Real Estate Report (76)

- Retirement (81)

- Selling (63)

- VA Loan (5)

- Veterans (6)

- Washington D.C (84)

Recent Posts