The 20% Down Payment Myth, Debunked

For decades, the idea that you must put down 20% to buy a home has been treated like an unwritten rule of real estate. Many potential buyers—even those with stable incomes and good credit—hold off on homeownership because they assume they need to save tens of thousands of dollars first.

Here’s the truth: you don’t need 20% down to buy a home. Not even close.

Saving up to buy a home can feel a little intimidating, especially right now. And for many first-time buyers, the idea that you have to put 20% down can feel like a major roadblock.

But that’s actually a common misconception. Here’s the truth.

Do You Really Have To Put 20% Down When You Buy a Home?

Unless your specific loan type or lender requires it, odds are you won’t have to put 20% down. There are loan options out there designed to help first-time buyers like you get in the door with a much smaller down payment.

For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants, like Veterans. So, while putting down more money does have its benefits, it’s not essential. As The Mortgage Reports says:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

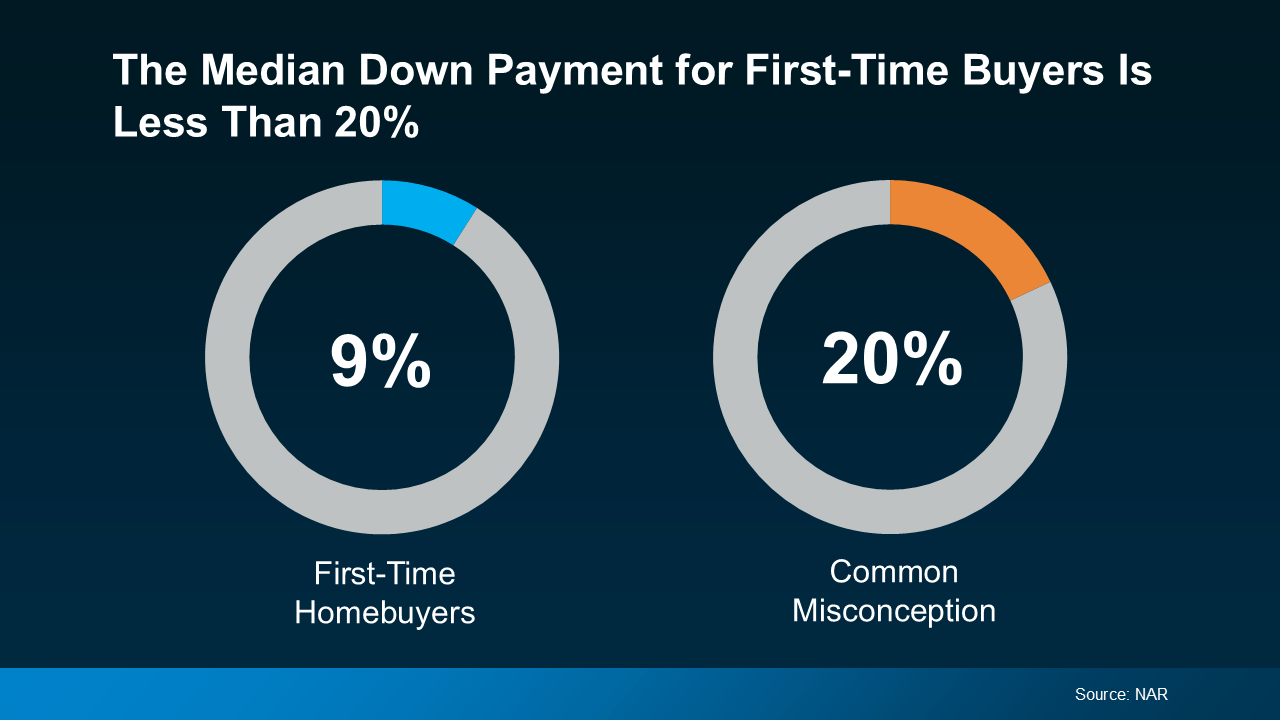

According to the National Association of Realtors (NAR), the median down payment is a lot lower for first-time homebuyers at just 9% (see chart below):

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.

And the best part is, there are also a lot of programs out there designed to give your down payment savings a boost. And chances are, you’re not even aware they’re an option.

Why You Should Look into Down Payment Assistance Programs

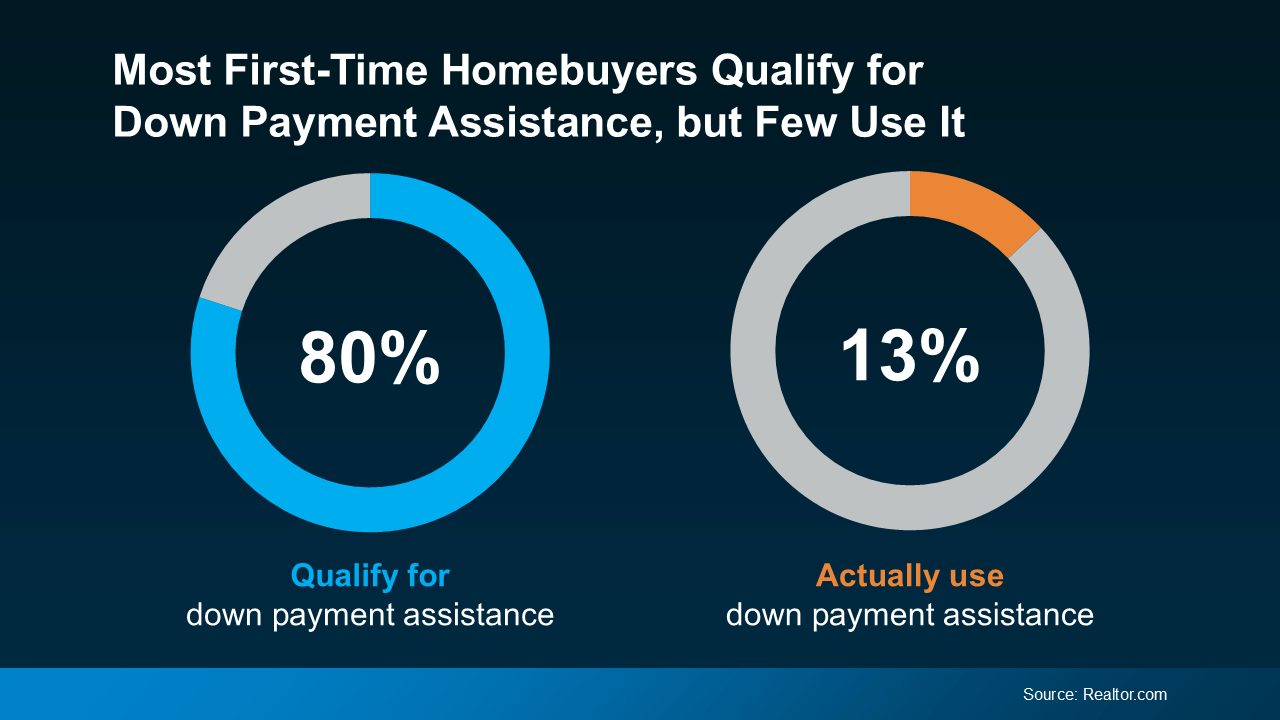

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance (DPA), but only 13% actually use it (see chart below):

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine how much further your homebuying savings would go if you were able to qualify for $17,000 worth of help. In some cases, you may even be able to stack multiple programs at once, giving what you’ve saved an even bigger lift. These are the type of benefits you don't want to leave on the table.

Where Did the 20% Myth Come From?

The 20% figure isn’t completely made up—it’s the threshold at which buyers typically avoid paying Private Mortgage Insurance (PMI). PMI is an additional monthly cost lenders require when your down payment is less than 20%. But avoiding PMI is not always worth putting your dreams on hold.

In reality, lenders offer a wide range of financing options with much lower down payment requirements.

What Are Your Real Options?

Here are some common home loan programs that require less than 20% down:

-

FHA Loans – Backed by the Federal Housing Administration, these loans allow down payments as low as 3.5% with a credit score of 580 or higher.

-

VA Loans – For eligible veterans and active-duty service members, no down payment is required at all.

-

USDA Loans – For rural and some suburban areas, this program also offers 0% down payment options.

-

Conventional Loans – Many conventional lenders accept as little as 3% down, especially for first-time homebuyers.

Why Waiting for 20% Can Cost You More

Saving for a large down payment may sound financially responsible, but it can actually cost you:

-

Rising home prices: While you save, prices may climb, making homes less affordable.

-

Lost equity: Buying earlier means you start building equity sooner, even with a smaller down payment.

-

Renting longer: Every month you rent is money that isn’t building toward your own asset.

Small Down Payment, Smart Strategy

If you’re financially stable with reliable income, good credit, and manageable debt, there’s a good chance you can buy a home with less than 20% down. Even with PMI, homeownership often becomes more affordable over time compared to renting.

And remember: you can always refinance later or pay extra toward your loan principal if your goal is to eliminate PMI faster.

Final Thoughts

The 20% down payment myth has kept too many people from achieving homeownership. In today’s market, flexibility and education are key. By exploring your options and talking to a qualified lender or real estate professional, you may find that your dream home is closer than you think.

Thinking about buying a home but unsure where to start? Let’s talk through your options—no pressure, just honest advice.

To learn more about what’s available and if you’d qualify for any down payment assistance programs, talk to a trusted lender.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts