Does Your Current Home Fit Your Retirement Plans?

Retirement isn’t just a milestone. It's the beginning of something really special. After years of hard work, it’s finally time to slow down, explore new passions, and live life on your own terms.

But with this exciting chapter comes some big choices. And one of the biggest is this: does your current home still make sense for the lifestyle (and budget) you want in this next phase of life?

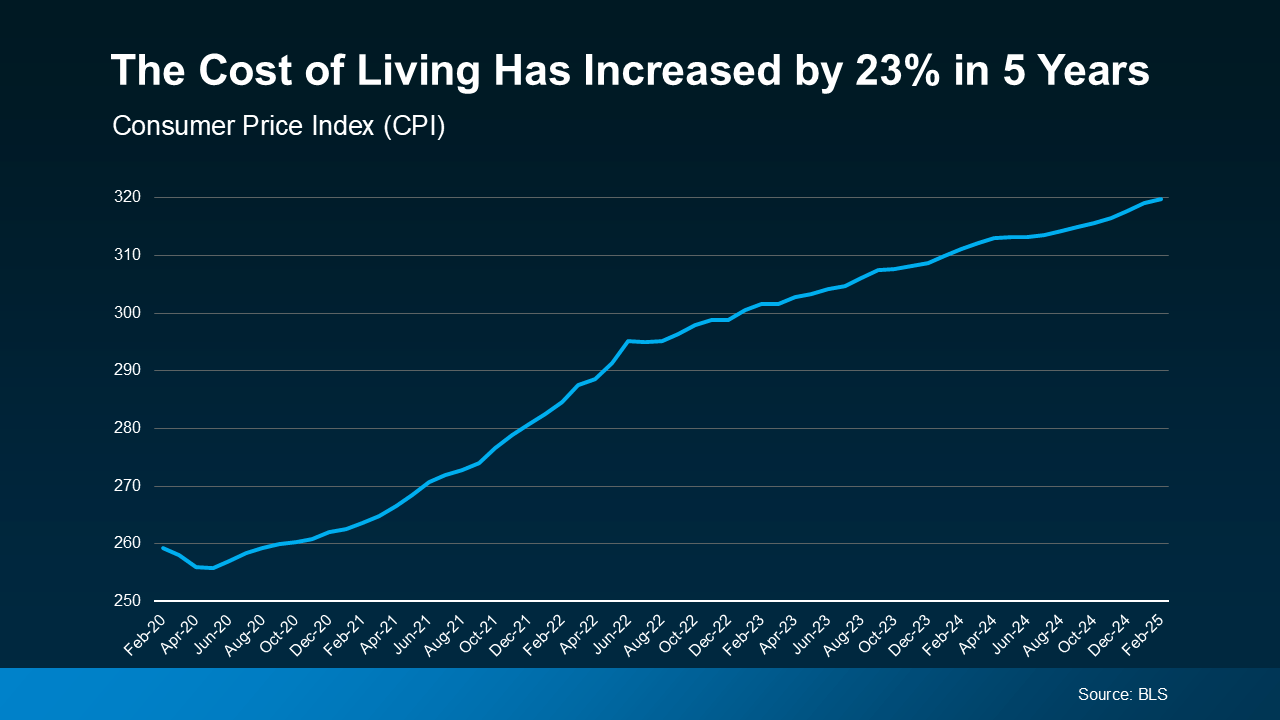

That’s an especially important question right now. Just in the past five years, the cost of living has jumped by 23% according to the Bureau of Labor Statistics (BLS). That’s based on the Consumer Price Index (CPI), which is how changes are tracked in the average price consumers pay for goods and services (see graph below):

When you’re thinking about how to make your retirement savings last, those rising expenses matter. And if you’ve started to wonder whether your money will stretch as far as you need it to go, don’t worry. You may have more control than you think.

When you’re thinking about how to make your retirement savings last, those rising expenses matter. And if you’ve started to wonder whether your money will stretch as far as you need it to go, don’t worry. You may have more control than you think.

One way many retirees are protecting their savings is by relocating. Because your dollars do go further in some places.

Moving to an area with a lower cost of living can help you save on regular expenses like your housing, utilities, and taxes – especially if you downsize at the same time.

And that can free up room in your budget for the things that make retirement some of the best years of your life: travel, hobbies, spoiling your grandkids, or any of the other things you’ve been dreaming about doing in this next phase.

That’s not to say you have to move. It just means you’ll want to think about where you plan to live and make sure you’ve got enough savings to cover actually living there. It's all about planning. As Go Banking Rates explains:

“How much you should have saved for retirement depends on a few key factors, including your location. Where you choose to spend your golden years is critical.”

And you don’t always have to go far. Sometimes it’s out of state, but other times moving to the suburbs instead of living near the city can make a big difference. And that’s worth thinking about as you plan for your next chapter.

Whether you’re considering downsizing, moving closer to your grandkids, or heading to an area where you can stretch your savings, a real estate agent can help. They’ll work with you to explore the options that make sense for your goals – and can help make selling your current house easier. They can also connect you with trusted agents in other parts of the country if you're considering a big move.

You’ve worked hard to build a future you can enjoy. If your current home or location no longer supports that, it may be time to explore what’s next.

What does your ideal retirement look like? And could a move help make it even better? Let’s talk about how to make that vision a reality.

Would you like this tailored for a specific audience—like retirees in a certain region, or with a focus on VA loans, FHA loans, or specific real estate services?

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts