Don’t Let Student Loans Hold You Back from Homeownership

Owning a home is a dream for many—but if you're one of the millions of Americans carrying student loan debt, you might be wondering if that dream is out of reach. The good news? It’s not. While student loans can impact your finances, they don’t have to stop you from buying a home. With the right strategy, preparation, and guidance, you can make homeownership a reality—even while paying off student loans.

Understand How Student Loans Affect Your Mortgage Approval

Student loans factor into your debt-to-income ratio (DTI), one of the key metrics lenders use to determine how much you can borrow. Your DTI is the percentage of your monthly income that goes toward debt payments. A lower DTI generally makes you a more attractive borrower.

The key is to manage your payments and credit responsibly. Consistently paying your student loans on time and keeping your overall debt manageable can show lenders you're a responsible borrower.

Strengthen Your Credit Score

A good credit score can improve your chances of getting approved for a mortgage and securing a better interest rate. Here's how to boost it:

-

Make all payments on time (including student loans)

-

Avoid opening new credit lines right before applying for a mortgage

-

Keep credit card balances low

-

Check your credit report for errors

Even with student loans, a strong credit history speaks volumes.

Explore Loan Programs That Work with Student Debt

You may qualify for mortgage programs specifically designed for buyers with student loan debt, including:

-

FHA Loans: These offer more lenient credit and DTI requirements, and your student loan payments can be calculated based on your actual payment amount rather than a flat percentage of your balance.

-

Conventional Loans with Fannie Mae or Freddie Mac: These programs now allow lenders to use your actual monthly payment—even if it’s on an income-driven repayment (IDR) plan—when calculating DTI.

-

First-Time Homebuyer Programs: Many states offer grants, down payment assistance, or special financing for first-time buyers—even those with student loans.

Get Pre-Approved and Know Your Budget

Before house hunting, get pre-approved for a mortgage. This gives you a clear understanding of what you can afford and how your student loan payments impact your budget. Pre-approval also shows sellers you're serious and financially prepared.

Don’t Go It Alone—Get Professional Help

Working with a real estate professional and a knowledgeable lender can make all the difference. They’ll help you understand your options, prepare your finances, and guide you through each step of the buying process.

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you're wondering:

- Do you have to wait until you’ve paid off those loans before you can buy your first home?

- Or is it possible you could still qualify for a home loan even with that debt?

Having questions like these is normal, especially when you’re thinking about making such a big purchase. But you should know, you may be putting your homeownership goals on the backburner unnecessarily.

Can You Qualify for a Home Loan if You Have Student Loans?

In the simplest sense, what you want to know is can you still buy your first home if you have student debt. Here’s what Yahoo Finance says:

" . . . student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible."

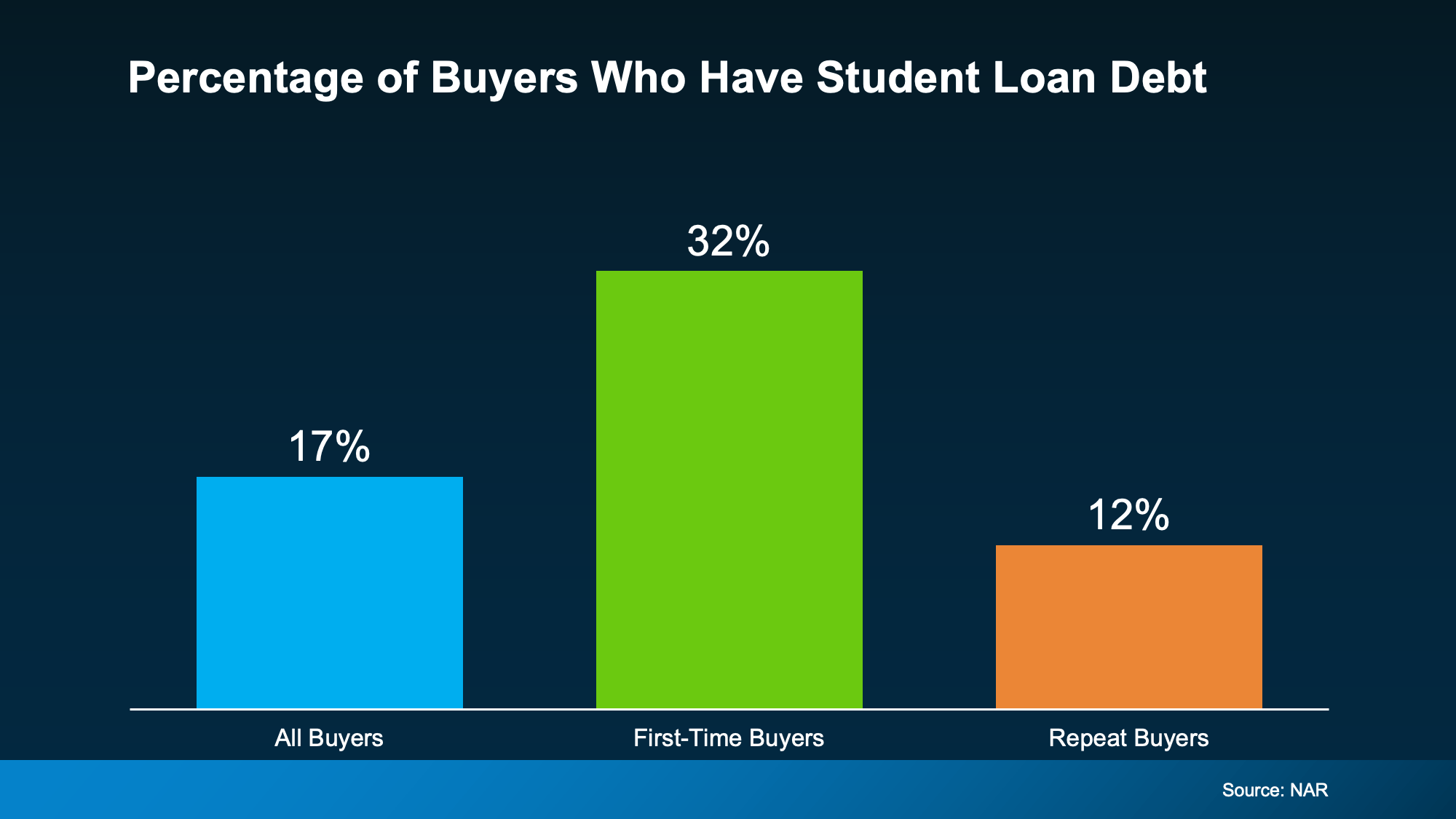

And the data backs this up. An annual report from the National Association of Realtors (NAR), shows that 32% of first-time buyers had student loan debt (see graph below):

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

“It’s important to note that student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

If your income is steady and your overall finances are solid, homeownership can still be within reach. So, having student loans doesn’t necessarily mean you have to wait to buy a home.

Bottom Line

Student loans are a part of life for many, but they don’t have to define your financial future. With smart planning and the right support, homeownership is still within reach. Don’t let debt discourage you—let it motivate you to make informed, confident steps toward your dream home.

Ready to explore your options? Let’s connect and see what’s possible!

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (108)

- Agent (100)

- Baltimore (95)

- Baltimore Real Estate (92)

- Buying (92)

- Closing Cost (7)

- Commercial Real Estate (89)

- D.C (92)

- Downsizing (84)

- Equity (104)

- First time homebuying (85)

- home buying tips (88)

- Home Selling (61)

- home selling tips (22)

- Homebuying (87)

- Investing (100)

- Lower Prices (99)

- Market Reports (79)

- Market Update (81)

- Maryland (98)

- Maryland Real Estate (98)

- mortgage (78)

- mortgage rates (80)

- purchasing a home (87)

- Real Estate (102)

- Real Estate Agent (102)

- Real Estate Report (77)

- Retirement (82)

- Selling (64)

- VA Loan (6)

- Veterans (7)

- Washington D.C (85)

Recent Posts