Do You Know How Much Your Home Is Worth?

Over the past few years, you’ve probably seen a whole lot of headlines about how home prices keep going up. But have you ever stopped to think about what that actually means for your home?

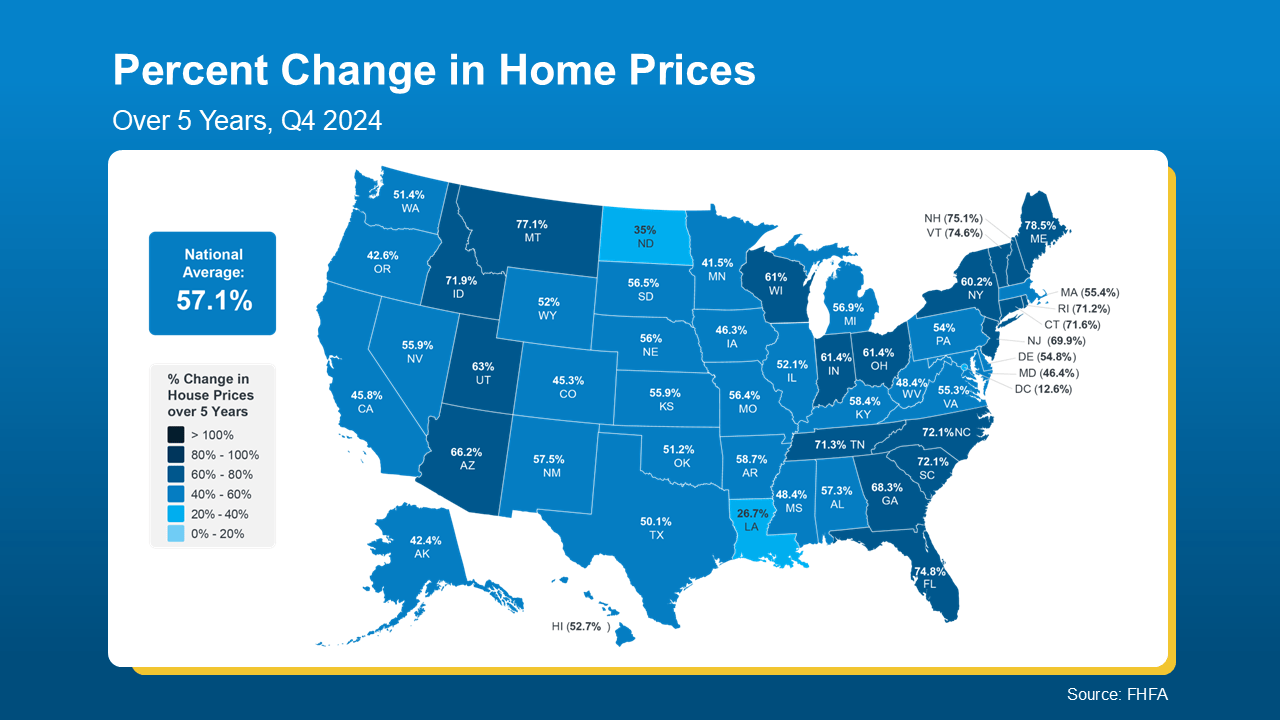

Home prices have risen dramatically over the past five years — far more than usual. And if selling has been on your mind, this could mean a bigger-than-expected payday when you list. So, how much has your home’s value really changed? Let’s break it down.

The Rapid Rise of the Past 5 Years

Typically, home prices go up by about 2-5% a year. But in 2021-2022, there were double-digit increases. And at the peak, prices rose by a staggering 20% or more nationally. Why? There were way more buyers than homes available, which sent prices soaring. While things have normalized since then, you still get to reap the benefits of those massive increases.

Your house has gained way more value than it normally would in such a short period of time – and that means a lot more wealth for you, too.

The map below uses data from the Federal Housing Finance Agency (FHFA) to show that, nationally, prices have gone up by nearly 60% in just the past 5 years alone. Here’s a breakdown that takes that one step further and gives you the numbers by state:

If you’re a homeowner, one of the most important questions you can ask yourself is, “How much is my home worth?” Whether you’re considering selling, refinancing, or simply keeping tabs on your investment, understanding your home’s value is crucial. Let’s explore the factors that influence home value and how you can determine yours.

Why Home Value Matters

Your home’s value isn’t just a number—it’s a key financial indicator. It affects your ability to refinance, take out a home equity loan, or negotiate the best price if you decide to sell. A well-informed homeowner is in a stronger financial position, so staying updated on your home’s worth is a smart move.

Factors That Influence Home Value

Several factors determine the market value of a home, including:

-

Location – Homes in desirable neighborhoods with good schools, amenities, and low crime rates tend to have higher values.

-

Size & Layout – Square footage, number of bedrooms and bathrooms, and overall layout impact the value significantly.

-

Condition & Upgrades – Renovations, modern appliances, and updated features can increase a home’s value.

-

Market Conditions – The current real estate market, including supply and demand trends, interest rates, and economic conditions, plays a crucial role.

-

Comparable Sales (Comps) – The selling prices of similar homes in your area help determine your home’s fair market value.

Ways to Determine Your Home’s Value

1. Online Home Valuation Tools

There are many online tools that provide instant home value estimates based on public records and recent sales. While these tools offer a rough estimate, they may not always be accurate.

2. Work With a Real Estate Agent

A local real estate professional can provide a Comparative Market Analysis (CMA), which evaluates recent home sales in your area and considers unique aspects of your property.

3. Hire a Professional Appraiser

If you need an official valuation, a licensed appraiser will conduct an in-depth analysis, including property condition, location, and market trends, to determine an accurate home value.

4. Analyze Recent Sales in Your Neighborhood

Checking comparable sales (comps) in your neighborhood can give you insight into what similar homes are selling for.

How to Increase Your Home’s Value

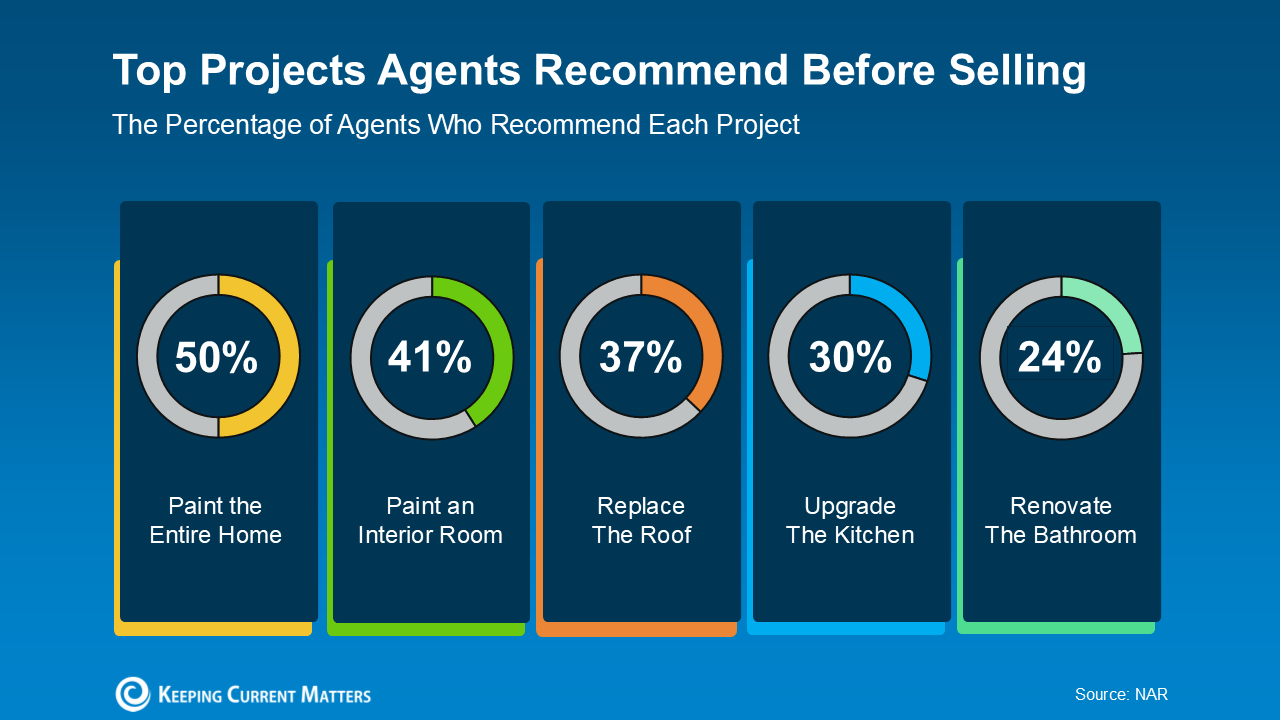

If you’re planning to sell or refinance in the near future, there are ways to boost your home’s value:

-

Enhance Curb Appeal – Fresh landscaping, a clean exterior, and a welcoming entrance make a big difference.

-

Make Small Upgrades – Updating fixtures, repainting walls, and improving lighting can add value without major renovations.

-

Invest in Energy Efficiency – Smart home features, new windows, and better insulation can appeal to buyers and increase value.

-

Address Maintenance Issues – Fixing leaky faucets, replacing outdated systems, and keeping the home well-maintained prevents value loss.

Final Thoughts

Knowing your home’s worth is essential for making informed financial decisions. Whether you’re preparing to sell, refinance, or just want to stay informed, taking the time to assess your home’s value is always a smart move. If you’re looking for a personalized home valuation, consider reaching out to a trusted real estate professional for expert insights.

Want to know what your home is worth today? Contact us for a free home valuation and expert advice!

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (111)

- Agent (103)

- Baltimore (98)

- Baltimore Real Estate (95)

- Buying (93)

- Closing Cost (10)

- Commercial Real Estate (92)

- D.C (95)

- Downsizing (87)

- Equity (107)

- First time homebuying (86)

- home buying tips (89)

- Home Selling (64)

- home selling tips (25)

- Homebuying (89)

- Investing (101)

- Lower Prices (102)

- Market Reports (82)

- Market Update (84)

- Maryland (101)

- Maryland Real Estate (101)

- mortgage (81)

- mortgage rates (83)

- purchasing a home (89)

- Real Estate (105)

- Real Estate Agent (105)

- Real Estate Report (79)

- Retirement (83)

- Selling (67)

- VA Loan (6)

- Veterans (7)

- Washington D.C (88)

Recent Posts