How Home Equity Can Help Fuel Your Retirement

As the years go by, many homeowners find themselves contemplating their retirement plans and how to best utilize their assets to secure a comfortable future. One of the most significant assets for many is their home, which can serve as a powerful financial tool in retirement. Home equity—the portion of your home that you truly own—can be tapped into to enhance your retirement lifestyle, providing you with the funds needed for travel, healthcare, or even just to enjoy life without financial stress.

For those planning to retire in 2025, now may be the perfect time to consider downsizing and unlocking that equity. With the real estate market fluctuating, making strategic decisions about your property can lead to significant benefits.

Understanding Home Equity

Home equity is calculated as the current market value of your home minus any outstanding mortgage balances. For example, if your home is worth $400,000 and you owe $200,000 on your mortgage, you have $200,000 in equity. This equity can be accessed through various means such as selling your home or taking out a home equity loan or line of credit.

If retirement is on the horizon, now’s the time to start thinking about your next chapter. And you probably want to make sure you’re set up to feel comfortable financially to live the life you want in retirement.

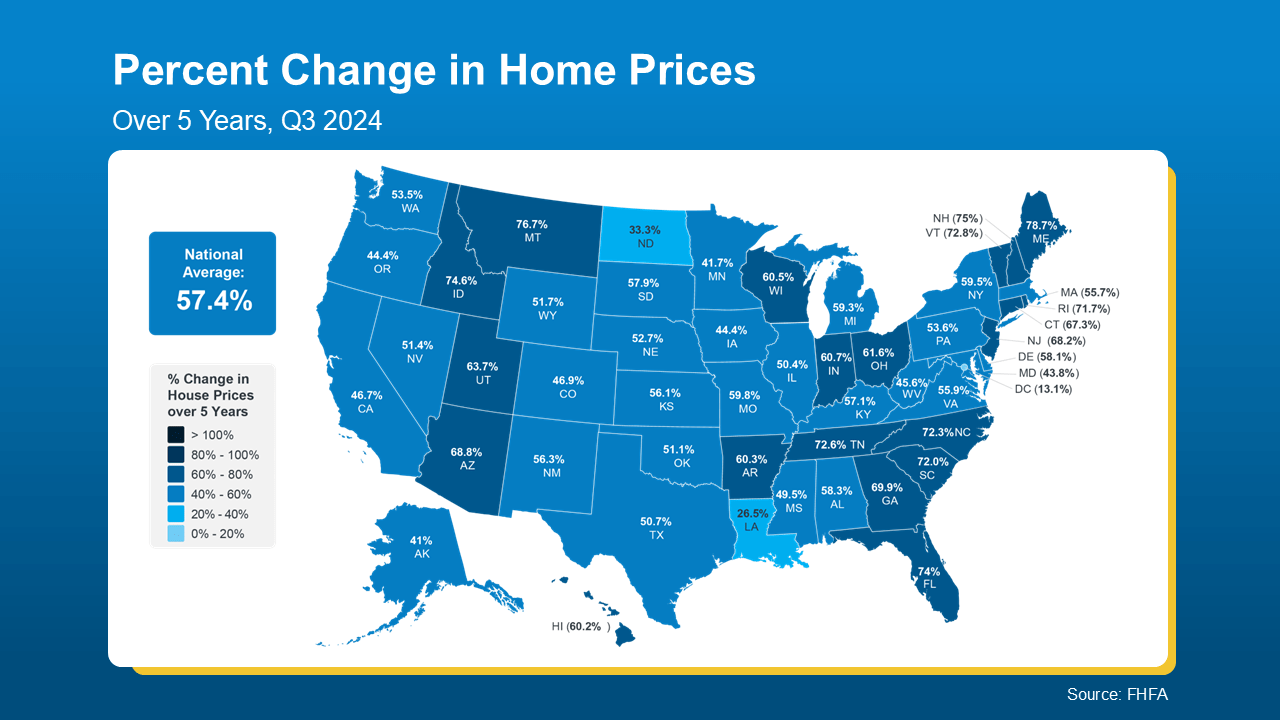

What you may not realize is you likely have a hidden goldmine of cash you’re not thinking about — and that’s your home. Data from the Federal Housing Finance Agency (FHFA) shows that home values have gone up nearly 60% over the last 5 years alone (see graph below):

The Benefits of Downsizing

Downsizing can be an excellent way to unlock home equity while reducing living expenses. As homeowners age, their needs often change; maintaining a large family home may become impractical and costly. By selling your current home and purchasing a smaller one—perhaps in a more affordable area or a community designed for retirees—you can free up cash that can be used for retirement savings or other investments.

1. Financial Flexibility: Selling your larger home allows you to pay off existing mortgages and eliminate monthly housing costs altogether. This financial flexibility can provide peace of mind as you transition into retirement.

2. Reduced Maintenance Costs: A smaller home typically requires less maintenance and fewer repairs, which translates into lower expenses. This reduction in upkeep not only saves money but also frees up time for enjoying retirement activities.

3.Accessing Cash: The proceeds from selling your larger home can significantly boost your retirement fund. For instance, if you sell your home for $500,000 and purchase a smaller one for $300,000, you could potentially pocket $200,000 that could be invested or used to support your lifestyle.

Timing is Everything

If you're considering this transition before retiring in 2025, timing plays a crucial role. The real estate market can be unpredictable; therefore, it’s wise to consult with real estate professionals who understand current trends and can help you navigate the buying and selling process effectively.

Mortgage Considerations

When downsizing, it's essential to evaluate your mortgage options carefully. If you're purchasing a new property after selling your existing one, consider whether you'll need another mortgage or if you'll buy outright with cash from the sale proceeds.

1. Low-Interest Rates: If interest rates remain low leading up to 2025, it may be advantageous to secure a new mortgage on a smaller property while utilizing some of the equity from your previous home as a down payment.

2. Reverse Mortgages: For retirees aged 62 and older looking to stay in their homes but access cash from their equity without having to sell their property outright, reverse mortgages can be an option worth exploring.

3.Home Equity Lines of Credit (HELOC): If downsizing isn’t immediately feasible but you still want access to cash from your home's equity, consider setting up a HELOC against your current property before making any moves.

Selling Your Home

Once you've decided to downsize and unlock your home's equity, it’s time to prepare for selling:

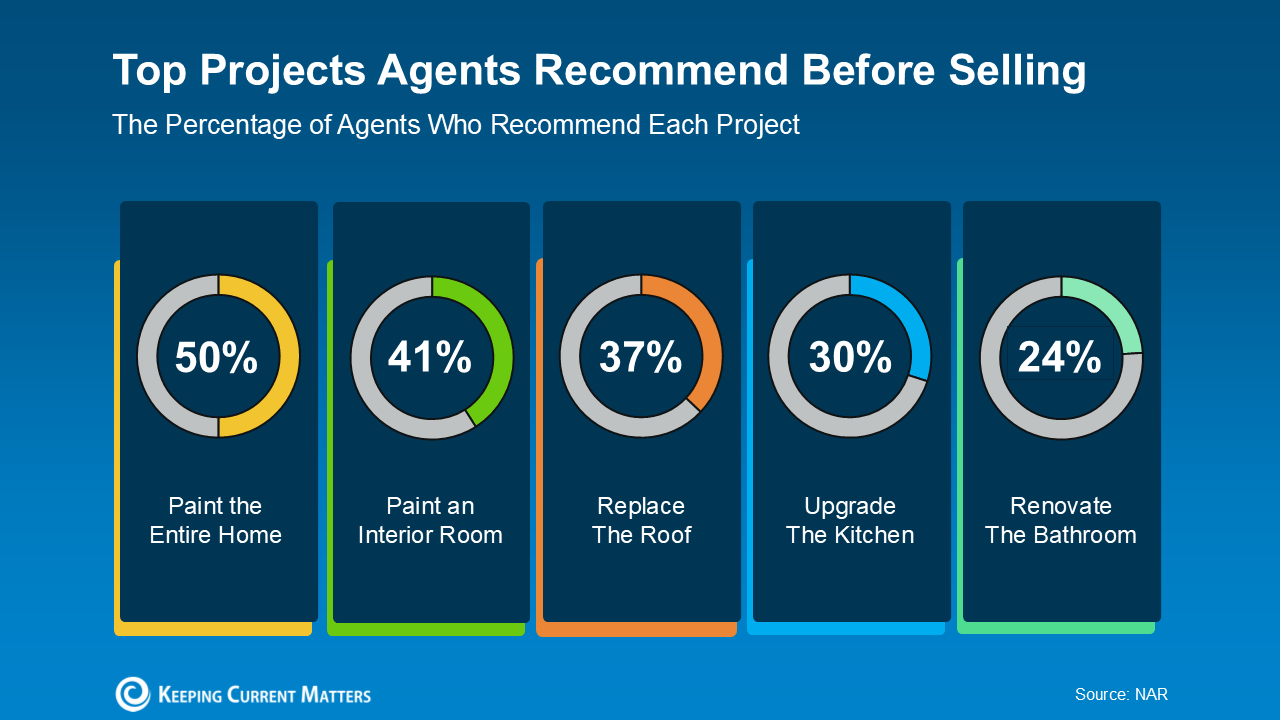

1. Home Improvements: Invest in minor renovations that could increase the value of your property before listing it on the market—fresh paint or landscaping can make a big difference.

2. Staging Your Home: Presenting your home well is key; staging can help potential buyers envision themselves living there and may lead to quicker sales at higher prices.

3. Choosing the Right Agent: Partnering with an experienced real estate agent who understands local market conditions will ensure that you get top dollar for your property while helping you find an ideal new place that meets your retirement needs.

Conclusion

Unlocking home equity through downsizing not only provides access to much-needed funds but also allows retirees the opportunity to simplify their lives as they enter this new phase of life. By understanding how buyers and sellers interact within the real estate market and considering all available mortgage options, homeowners planning for retirement in 2025 can make informed decisions that enhance their financial stability during their golden years.

As always, seeking advice from financial advisors alongside real estate professionals will help ensure you're making choices that align with both your immediate needs and long-term goals for retirement living.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (111)

- Agent (103)

- Baltimore (98)

- Baltimore Real Estate (95)

- Buying (93)

- Closing Cost (10)

- Commercial Real Estate (92)

- D.C (95)

- Downsizing (87)

- Equity (107)

- First time homebuying (86)

- home buying tips (89)

- Home Selling (64)

- home selling tips (25)

- Homebuying (89)

- Investing (101)

- Lower Prices (102)

- Market Reports (82)

- Market Update (84)

- Maryland (101)

- Maryland Real Estate (101)

- mortgage (81)

- mortgage rates (83)

- purchasing a home (89)

- Real Estate (105)

- Real Estate Agent (105)

- Real Estate Report (79)

- Retirement (83)

- Selling (67)

- VA Loan (6)

- Veterans (7)

- Washington D.C (88)

Recent Posts