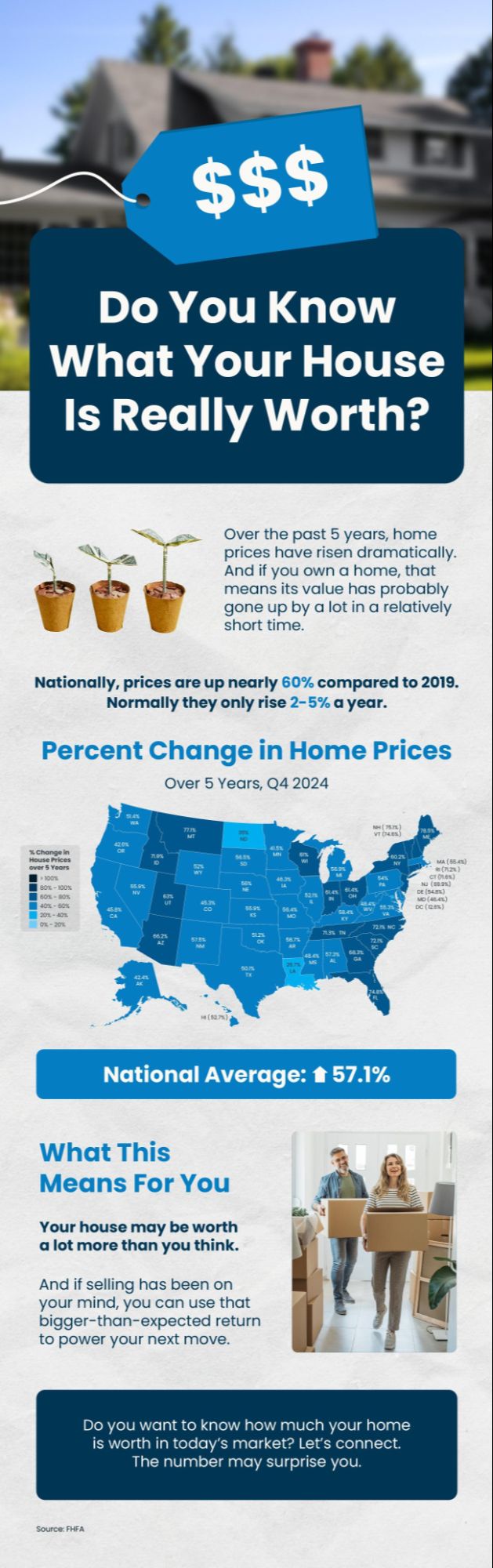

Do You Know What Your House Is Really Worth?

If you’re thinking about selling your home, refinancing, or simply curious about your property’s value, understanding its true worth is essential. Many homeowners rely on online estimates or past purchase prices, but these numbers can be misleading. Here’s how to get a more accurate picture of your home’s value and why it matters.

Factors That Influence Your Home’s Value

-

Market Conditions – The real estate market fluctuates due to supply and demand, interest rates, and economic factors. A seller’s market with low inventory can drive prices up, while a buyer’s market can lower them.

-

Location, Location, Location – Your home’s neighborhood, proximity to schools, amenities, public transport, and crime rates all play a role in its value.

-

Home Size and Condition – The square footage, number of bedrooms and bathrooms, renovations, and overall condition significantly impact value.

-

Comparable Sales (Comps) – Recent sales of similar homes in your area provide a baseline for your home’s value.

-

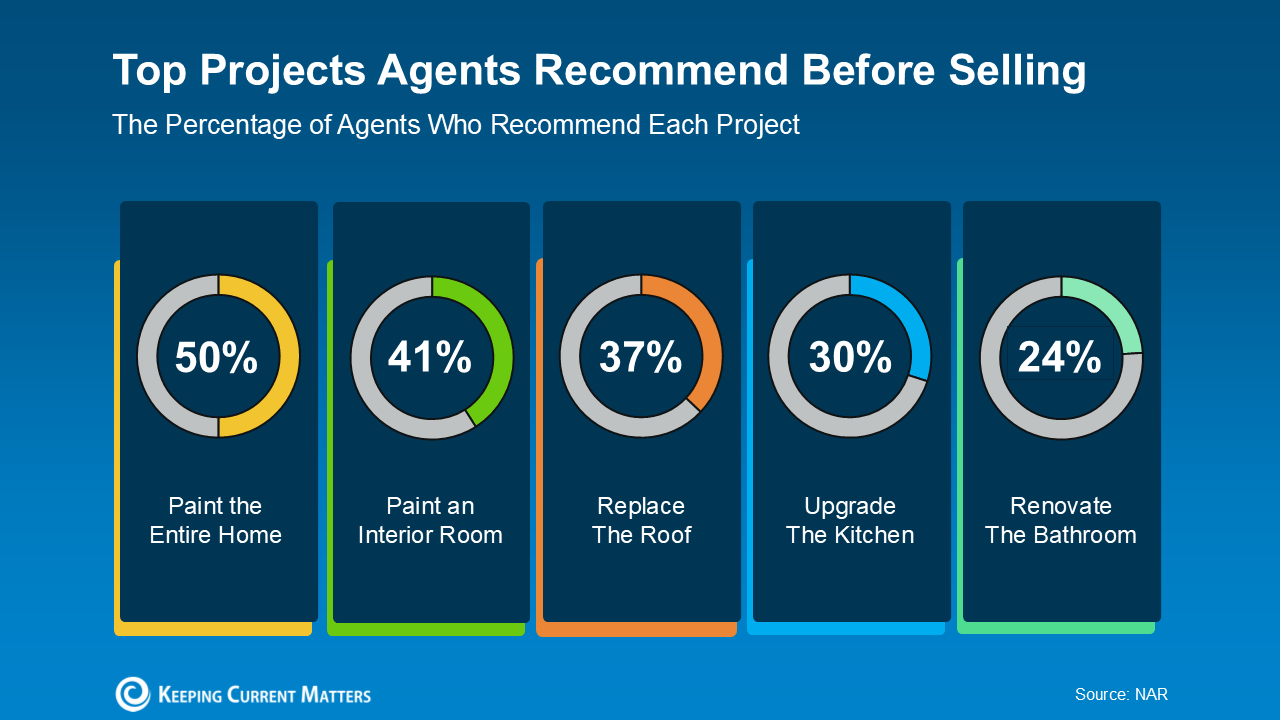

Curb Appeal and Upgrades – A well-maintained home with modern upgrades can increase value, while outdated features or neglected maintenance can lower it.

Ways to Determine Your Home’s Value

-

Online Home Value Estimators – Websites like Zillow and Redfin offer automated estimates, but these are often rough approximations based on limited data.

-

Comparative Market Analysis (CMA) – A real estate agent can provide a detailed report comparing your home to recent local sales.

-

Professional Appraisal – Hiring a licensed appraiser provides the most accurate valuation, often required for refinancing or selling.

-

Home Inspections – Identifying potential repairs and issues can impact how much buyers are willing to pay.

Why Knowing Your Home’s Value Matters

-

Selling Your Home – Pricing your home correctly ensures you attract buyers without leaving money on the table.

-

Refinancing – Lenders use your home’s value to determine loan terms and interest rates.

-

Property Taxes – Overpaying due to an inflated tax assessment? You may be able to appeal and lower your tax bill.

-

Investment Planning – Understanding equity in your home helps with future financial decisions, like purchasing another property or funding home improvements.

Get a Free Home Valuation

If you’re curious about your home’s value, don’t rely on guesswork. Contact us, your trusted real estate professional for a free, no-obligation home valuation. An expert can provide insights tailored to your specific property and market conditions.

Your home is one of your most significant investments—make sure you know what it’s really worth!

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts