Buying a Home May Help Shield You from Inflation

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected – and that’s impacting the costs of goods, services, and more. And with rising costs all around you, you’re probably questioning: is now really the right time to buy a home?

Here’s the good news. Owning a home is actually one of the best ways to protect yourself from the rising costs that come with inflation.

A Fixed Mortgage Protects You from Rising Housing Costs

One of the key benefits of homeownership is that when you buy a home with a fixed-rate mortgage, your biggest monthly expense — your mortgage payment — stabilizes. Sure, your payment could rise slightly as your homeowner’s insurance and property taxes shift. But no matter what happens with inflation, your principal and interest payments won’t change.

That’s not the case if you rent. Rent tends to rise over time, and it usually goes up even faster than the rate of inflation. Just look at the data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

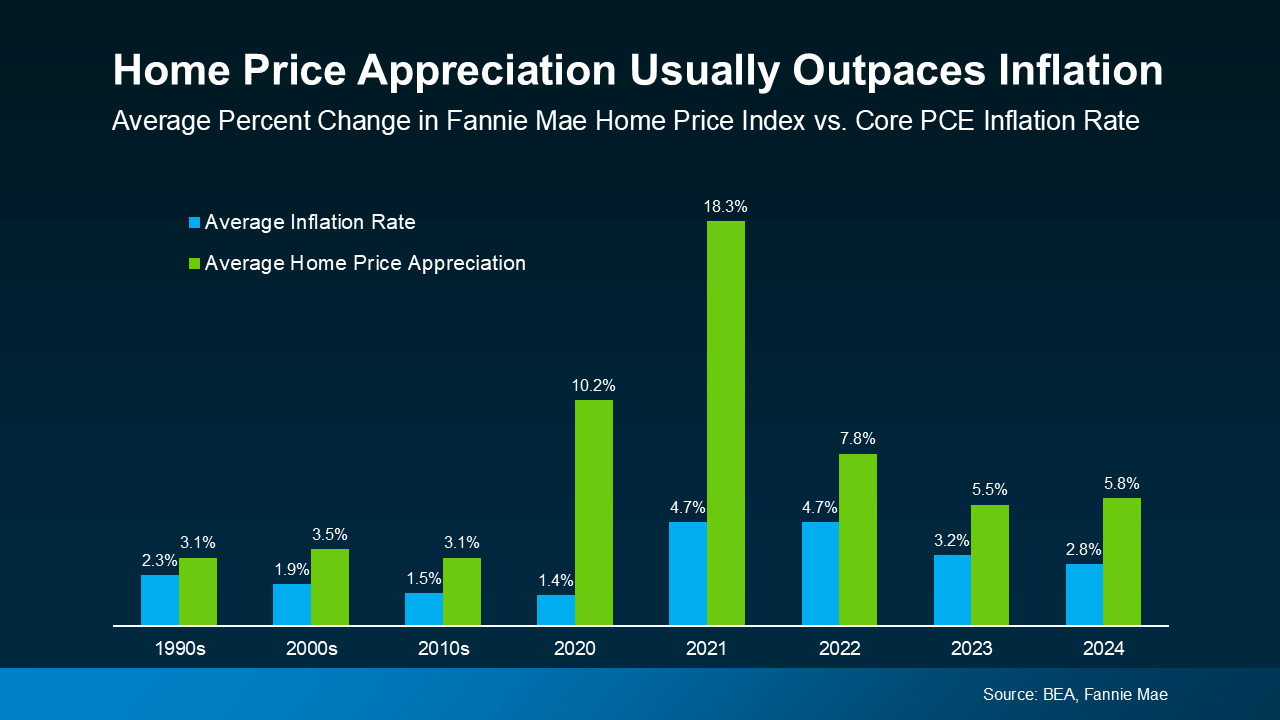

Home Prices Typically Rise Faster Than Inflation

Another big reason homeownership is a great hedge against inflation is that home values tend to appreciate over time — often at a higher rate than inflation, according to data from the BEA and Fannie Mae (see graph below):

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

On the other hand, renting offers no protection against inflation. In fact, it does the opposite — when inflation drives up costs, landlords often pass those increases onto tenants through higher rents.

That means as a renter, you’re continually paying more without gaining any financial benefit. But as a homeowner, rising prices work in your favor by increasing the value of your home and growing your equity over time.

And with experts forecasting continued home price growth, that means you’re making an investment that usually grows in value and should outperform inflation in the years ahead.

In short, a fixed-rate mortgage protects your budget, and home price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.

Buying a Home May Help Shield You from Inflation

Inflation affects almost every aspect of our daily lives, from the cost of groceries to gas prices and even rent. As prices continue to rise, many people are looking for ways to protect their finances. One often-overlooked strategy? Homeownership. Buying a home can serve as a strong hedge against inflation, offering financial stability and long-term benefits.

Fixed Housing Costs vs. Rising Rents

One of the biggest financial advantages of buying a home is securing a fixed monthly mortgage payment. If you opt for a fixed-rate mortgage, your principal and interest payments remain the same over time, shielding you from the rising cost of rent. Meanwhile, renters often face annual increases as landlords adjust prices to keep up with inflation. Owning a home allows you to lock in your housing costs, providing more predictability in your budget.

Home Values Tend to Rise with Inflation

Historically, real estate has been an appreciating asset, meaning home values tend to increase over time. Inflation contributes to this by driving up the cost of materials, labor, and land, which in turn pushes property values higher. This means that if you own a home, its value is likely to rise along with inflation, helping to build your net worth over time.

Building Equity Instead of Paying Rent

When you pay rent, you're essentially covering your landlord’s mortgage and helping them build wealth. When you own a home, however, each mortgage payment contributes to your own equity—the portion of the home you truly own. Over time, as you pay down your mortgage and home values appreciate, your wealth grows. This can provide financial security and options for the future, whether through refinancing, selling, or leveraging your equity for other investments.

Protecting Against Market Volatility

Unlike stocks and other investments, real estate tends to be more stable during periods of economic uncertainty. While markets may fluctuate, housing generally maintains its value or appreciates over time. This makes homeownership a reliable long-term investment that can help safeguard your wealth during times of inflation and economic downturns.

Additional Income Potential

Another way homeownership can protect against inflation is through income generation. If you own a home with extra space, you have the option to rent out a portion of it—such as a basement apartment or an accessory dwelling unit (ADU). This additional income can help offset mortgage costs and provide extra financial security.

Is Now the Right Time to Buy?

With mortgage rates fluctuating and home prices continuing to rise, some potential buyers may feel hesitant. However, waiting could mean facing higher costs in the future. Locking in a fixed mortgage now can help you stay ahead of inflation and take advantage of the long-term benefits of homeownership.

If you’re considering buying a home, working with a knowledgeable real estate professional can help you navigate the market and make informed decisions. With the right guidance, homeownership can be a powerful tool to protect your financial future against inflation.

Final Thoughts

While inflation affects nearly everything, homeownership offers a way to stabilize one of the biggest expenses in your budget—housing. By locking in fixed payments, building equity, and benefiting from property appreciation, buying a home can be one of the smartest financial moves to shield yourself from inflation. If you're ready to explore your options, now may be the perfect time to take that step toward long-term financial security.

Bottom Line

Inflation can make everyday expenses unpredictable, but owning a home gives you stability. Unlike rent, your monthly mortgage payment stays pretty much the same over time. Plus, the value of your home is likely to increase after you buy.

How would having a fixed housing payment change the way you budget for the future?

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts