Breaking Into the Market: Smart Moves for First-Time Buyers

Purchasing your first home is an exhilarating milestone, but it can also be a daunting process filled with numerous decisions and potential pitfalls. To navigate this journey successfully, it's essential to approach it with a strategic mindset. Here are some smart moves for first-time home buyers that can set you on the path to making a wise investment.

Think of Your First Home as a Stepping Stone

One of the most important pieces of advice for first-time buyers is to view your first home not necessarily as your forever home, but as a stepping stone. While it's tempting to find a property that checks every box on your dream list, remember that your needs and circumstances will likely evolve over time. By thinking of your first purchase as an entry point into the real estate market, you can make more practical decisions that align with your current financial situation and future goals.

Consider factors like resale value and market trends when choosing your first home. Opting for a property in an up-and-coming neighborhood or one that requires some cosmetic updates can provide opportunities for appreciation and equity growth. This approach allows you to build wealth over time, giving you the flexibility to upgrade to a more ideal home down the line.

Expand Your Search To Find More Affordable Options

In competitive real estate markets, affordability can be a significant barrier for first-time buyers. However, expanding your search parameters can uncover hidden gems that might otherwise go unnoticed. Instead of focusing solely on popular neighborhoods or specific property types, consider broadening your horizons to include emerging areas or different housing styles.

For instance, looking at suburban locations or smaller towns within commuting distance of major cities can reveal more affordable options without sacrificing quality of life. These areas often offer lower property taxes, reduced cost of living, and greater potential for future development and appreciation.

Additionally, consider alternative housing options such as condos, townhomes, or fixer-uppers. Condos and townhomes typically come with lower price tags compared to single-family homes and often include amenities like maintenance services and communal spaces. Fixer-uppers may require some initial investment in renovations but can ultimately provide excellent value if you're willing to put in the effort.

Get Pre-Approved for a Mortgage

Before you start house hunting in earnest, it's crucial to get pre-approved for a mortgage. This step not only helps you understand how much home you can afford but also strengthens your position as a serious buyer in the eyes of sellers. A pre-approval letter from a lender shows that you've undergone financial vetting and are capable of securing financing, which can be particularly advantageous in competitive markets where multiple offers are common.

Work with a Knowledgeable Real Estate Agent

Navigating the complexities of buying a home is much easier with the guidance of an experienced real estate agent. A knowledgeable agent can provide valuable insights into local market conditions, help you identify properties that meet your criteria, and negotiate on your behalf to secure the best possible deal. Look for agents who specialize in working with first-time buyers and have a deep understanding of the neighborhoods you're interested in.

Be Prepared for Additional Costs

Finally, it's essential to budget for additional costs beyond the purchase price of the home. Closing costs, property taxes, homeowners insurance, maintenance expenses, and potential repairs should all be factored into your financial planning. Having a clear understanding of these costs will prevent any unwelcome surprises down the road and ensure that you're fully prepared for homeownership.

In conclusion, purchasing your first home is an exciting journey that requires careful planning and strategic thinking. By viewing your first property as a stepping stone, expanding your search to find more affordable options, getting pre-approved for a mortgage, working with a knowledgeable real estate agent, and budgeting for additional costs, you'll be well-equipped to make smart decisions that pave the way for future success in the real estate market.

Expand Your Search To Find More Affordable Options

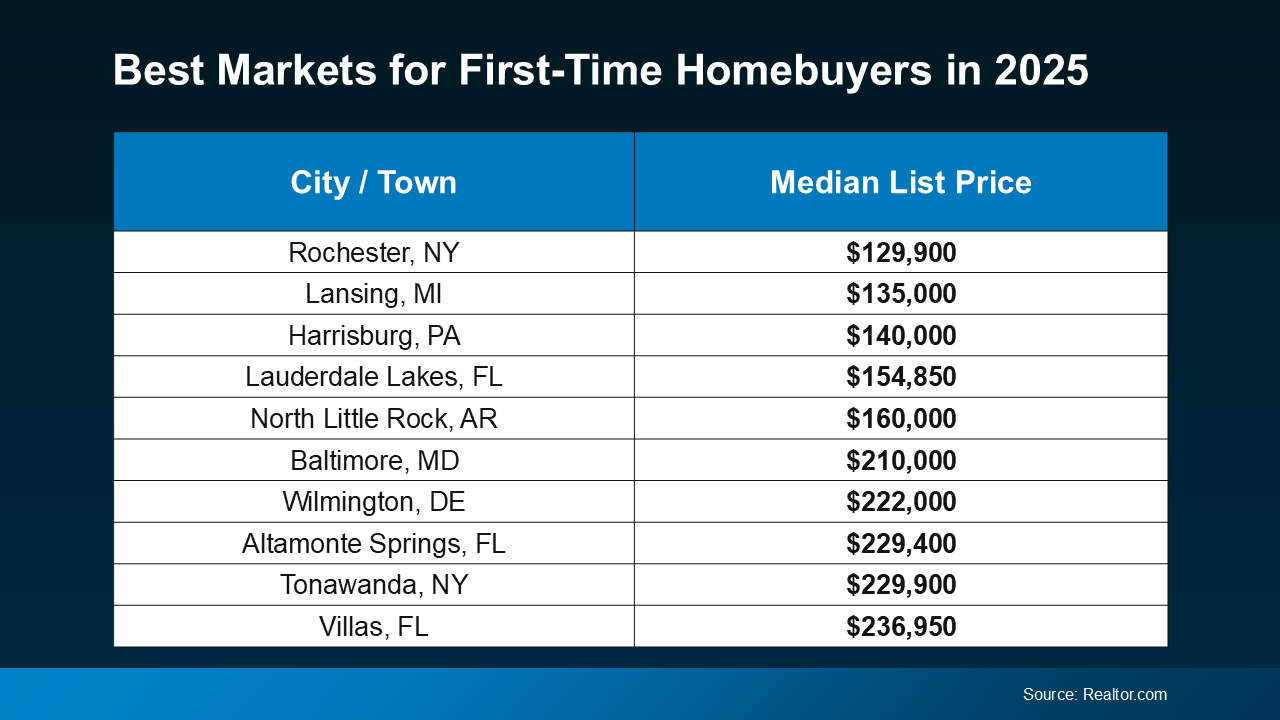

If high home prices in your favorite area are holding you back, it’s time to cast a wider net. By keeping an open mind and being flexible with location, you may be surprised at what’s possible within your budget. Many buyers find success by looking in surrounding areas – and some even choose to move out of state.

According to a report from Realtor.com, these are some of the best markets for first-time homebuyers this year (see chart below):

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

If you want to stay local, looking just outside your preferred neighborhood could help you find something you can afford that’s still pretty close to your favorite restaurants, shops, and activities. Sometimes, moving as little as 10 minutes away makes a big difference.

And the best way to see what’s available is to work with a real estate agent who understands the local market and can help you identify hidden gems nearby. An agent can point you to communities you may not have considered that have lower price tags now and are steadily gaining value and appeal. That way you can buy your first home and be set up to gain equity through the years.

Bottom Line

Today’s cost of living is a challenge for many homebuyers. But by exploring different areas and working with a knowledgeable agent, you can take that first step toward owning a home — and building equity for your future.

How far outside of your area would you look to make homeownership happen? Let’s connect to chat through your options.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts