Baltimore Metro Housing Market Report – January 2025

Housing Market Trends

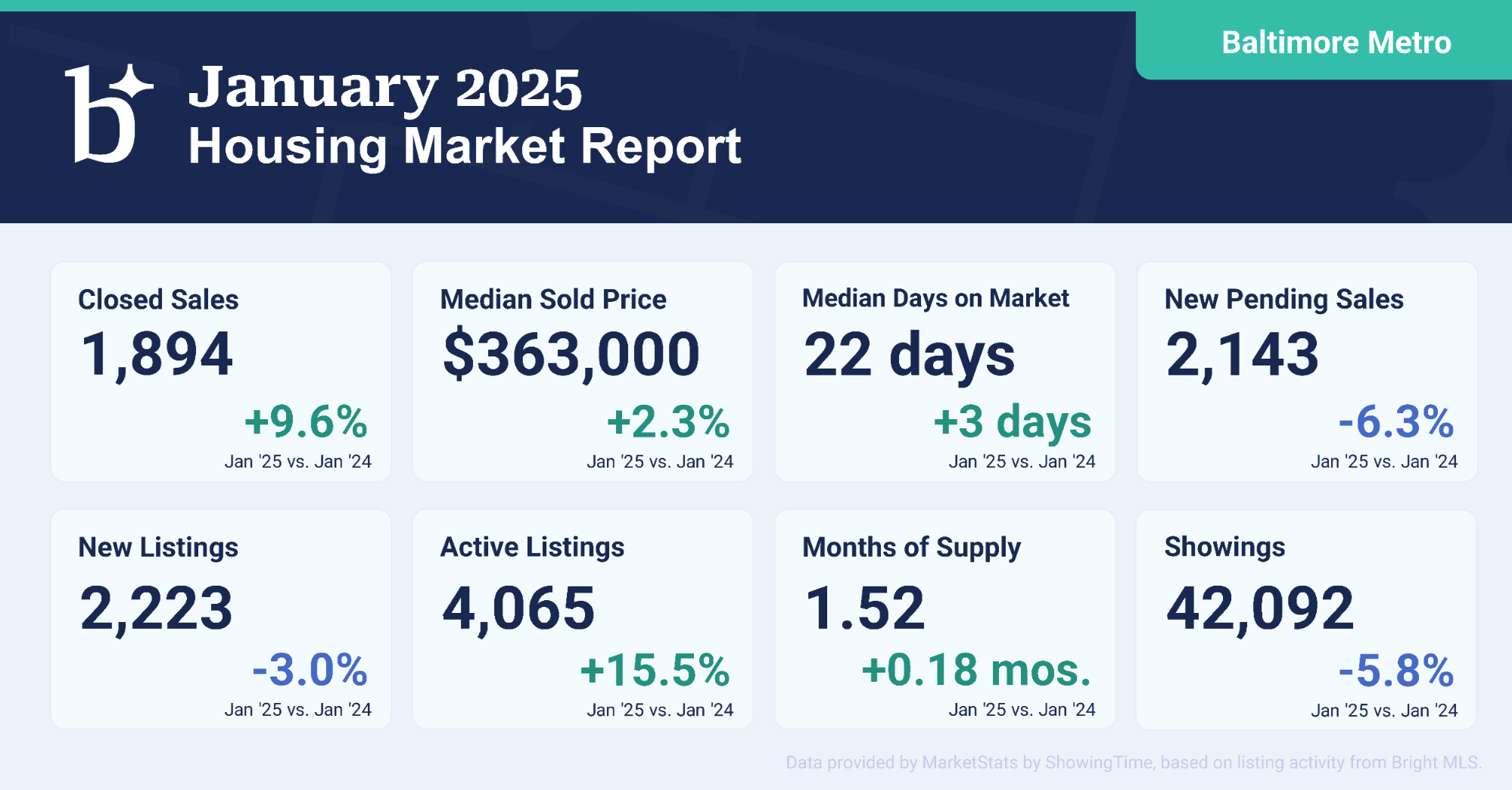

Affordability and uncertainty keep Baltimore area buyers on the sidelines. In January, the number of new pending sales across the Baltimore metro area was 6.3% lower than it was a year ago. Showing activity was also down by 5.8%. With mortgage rates near 7% and home prices rising by more than 40% over the past five years, some prospective buyers are simply priced out and are waiting for rates to come down. Listing activity is also relatively slow in the Baltimore region. A total of 2,223 new listings came onto the market in January, up from the record low in December, but still three percent lower than a year ago. There are signs that buyers have hit an affordability ceiling, particularly in the region’s suburban markets. In January, the median price was up 2.3%, the slowest pace of home price appreciation since May 2023. Price growth weakened in the Baltimore suburbs, but prices were up strongly in the city in January.

Market Outlook

Baltimore area buyers who had been hoping that 2025 would be the year they could get into the market might be waiting a little bit longer. Mortgage rates have remained persistently around 7% since the start of the year. Rates should come down over the coming months, which will bring some relief to buyers. However, with affordability a major constraint, more buyers may have to make compromises on neighborhood or home type in order to close on a home.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (113)

- Agent (105)

- Baltimore (99)

- Baltimore Real Estate (96)

- Buying (95)

- Closing Cost (12)

- Commercial Real Estate (94)

- D.C (96)

- Downsizing (89)

- Equity (109)

- First time homebuying (88)

- home buying tips (91)

- Home Selling (66)

- home selling tips (27)

- Homebuying (91)

- Investing (103)

- Lower Prices (104)

- Market Reports (84)

- Market Update (86)

- Maryland (102)

- Maryland Real Estate (102)

- mortgage (83)

- mortgage rates (85)

- purchasing a home (91)

- Real Estate (107)

- Real Estate Agent (107)

- Real Estate Report (81)

- Retirement (84)

- Selling (69)

- VA Loan (7)

- Veterans (9)

- Washington D.C (89)

Recent Posts

Washington, D.C. Metro Housing Market Report – November 2025

Baltimore Metro Housing Market Report –November 2025

Why Selling Your House This Winter Gives You an Edge

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

The Housing Market Is Turning a Corner Going into 2026

What a Government Shutdown Really Means for the Housing Market

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Planning to Sell in 2026? Start the Prep Now

Washington, D.C. Metro Housing Market Report – September 2025

Baltimore Metro Housing Market Report –September 2025

GET MORE INFORMATION

Follow Us