Are Investors Actually Buying Up All the Homes?

Are you trying to buy a home but you feel like you’re up against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, and that’s making it hard for regular buyers like you to compete.

But here’s the truth. Investor purchases are actually on the decline, and the big players aren’t nearly as active as you might think. Let’s dive into the facts and put this myth to rest.

Most Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are mom-and-pop investors who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who have another home they’re renting out or a vacation getaway.

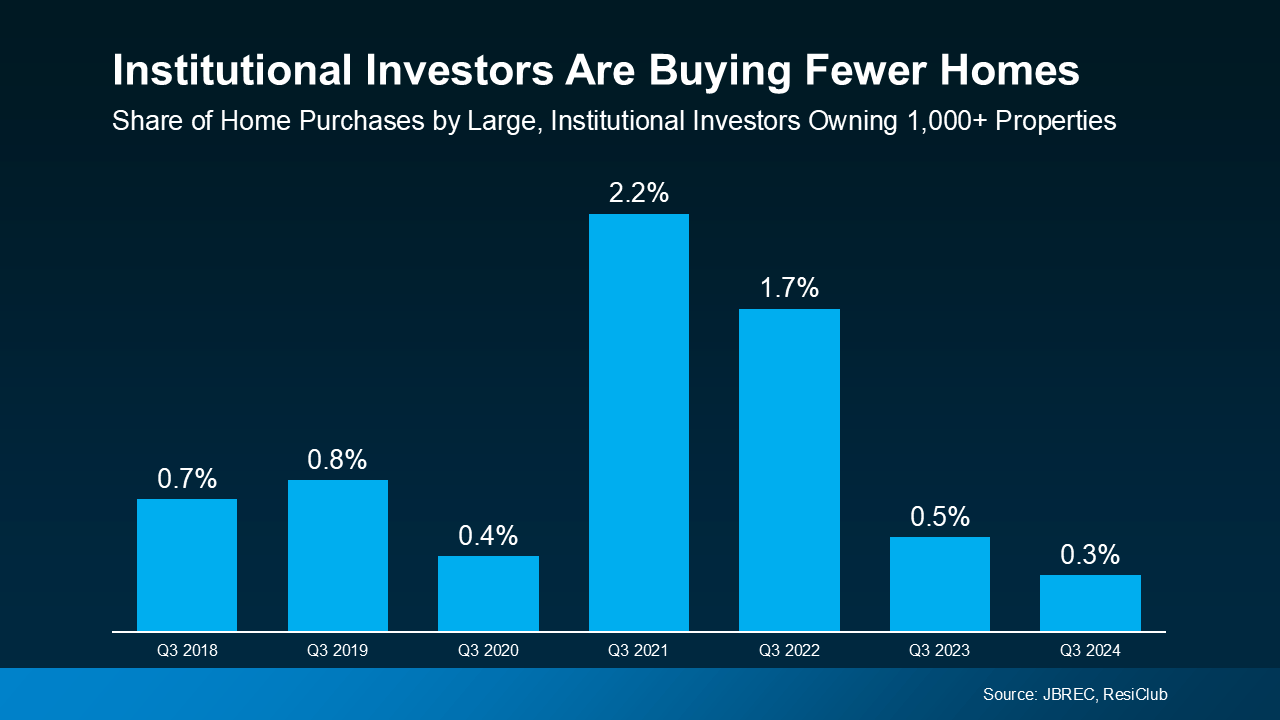

Investor Home Purchases Are Dropping

But what about the big investors you hear about in the news? Lately, those institutional investors – the ones that make headlines – have pulled back and aren’t buying as many homes.

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

Investors are clearly more reluctant to buy in today’s market, but why? The answer is largely because higher mortgage rates and home prices have made it less attractive for them.

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re not nearly as active as they were in past years.

Over the past few years, the real estate market has been buzzing with concerns that investors are buying up homes at an alarming rate, making it harder for individual buyers to compete. But is this really the case? Let’s take a closer look at the facts.

The Rise of Investor Purchases

Investors, both large institutional firms and smaller mom-and-pop landlords, have been increasingly active in the housing market. The reasons are simple: real estate is a stable asset that appreciates over time, and rental demand remains strong. With rising home prices and a competitive market, many investors see housing as a safe bet.

According to recent reports, investors accounted for roughly 20% of home purchases in some markets. While this may seem like a significant share, it also means that 80% of home purchases are still being made by individual buyers.

Are Investors Driving Up Prices?

Investors do play a role in increasing competition, but they are not the sole reason for skyrocketing home prices. Several factors contribute to rising prices, including:

-

Low Housing Inventory: A shortage of available homes has been one of the biggest drivers of price increases.

-

High Demand: Millennials, the largest generation, are now entering the homebuying market in full force.

-

Rising Construction Costs: Inflation, supply chain issues, and labor shortages have all made new home construction more expensive.

While investors do add competition, blaming them entirely for affordability challenges oversimplifies the issue.

Do Investors Only Buy Single-Family Homes?

A common misconception is that investors are primarily buying single-family homes, leaving first-time buyers out in the cold. While it’s true that some investors focus on single-family properties, many also target multi-family buildings, condos, and even commercial real estate. Additionally, many investor-owned properties are turned into rental housing, which helps meet demand for those unable or unwilling to buy.

How This Impacts First-Time Buyers

First-time homebuyers do face challenges when competing with investors, especially in competitive markets where cash offers are king. However, programs such as FHA loans and first-time buyer assistance can help level the playing field. Additionally, some states and cities are considering policies to limit investor purchases in certain areas to ensure more homes go to owner-occupants.

The Bottom Line

While investors are active in the real estate market, they are not buying up all the homes. The real issue is a lack of housing supply combined with high demand. For buyers, understanding market trends and seeking assistance through homebuyer programs can provide an edge in a competitive landscape.

If you're looking to navigate the current market—whether as a buyer, seller, or investor—working with a knowledgeable real estate professional can make all the difference.

Book your appointment and let’s talk to take the next step in your real estate journey. Schedule a real estate consultation with one of our team members.

Categories

- All Blogs (107)

- Agent (99)

- Baltimore (94)

- Baltimore Real Estate (91)

- Buying (91)

- Closing Cost (6)

- Commercial Real Estate (88)

- D.C (91)

- Downsizing (83)

- Equity (103)

- First time homebuying (84)

- home buying tips (87)

- Home Selling (60)

- home selling tips (21)

- Homebuying (86)

- Investing (99)

- Lower Prices (98)

- Market Reports (78)

- Market Update (80)

- Maryland (97)

- Maryland Real Estate (97)

- mortgage (77)

- mortgage rates (79)

- purchasing a home (86)

- Real Estate (101)

- Real Estate Agent (101)

- Real Estate Report (76)

- Retirement (81)

- Selling (63)

- VA Loan (5)

- Veterans (6)

- Washington D.C (84)

Recent Posts